目录

[Key terms](#Key terms)

[Accrued interest calculation](#Accrued interest calculation)

[Pricing of bonds](#Pricing of bonds)

[Measuring the yield](#Measuring the yield)

[Fixed vs Floating Rate Bonds | 固定利率 vs 浮动利率债券](#Fixed vs Floating Rate Bonds | 固定利率 vs 浮动利率债券)

[《The Bond Book》(Author: Annette Thau) Note 笔记](#《The Bond Book》(Author: Annette Thau) Note 笔记)

[Bonds Defined 债券定义](#Bonds Defined 债券定义)

[Bond Vocabulary 债券词汇](#Bond Vocabulary 债券词汇)

[Where to trade](#Where to trade)

Key terms

Face Value / Par Value / Nominal Value (面值)

Coupon rate

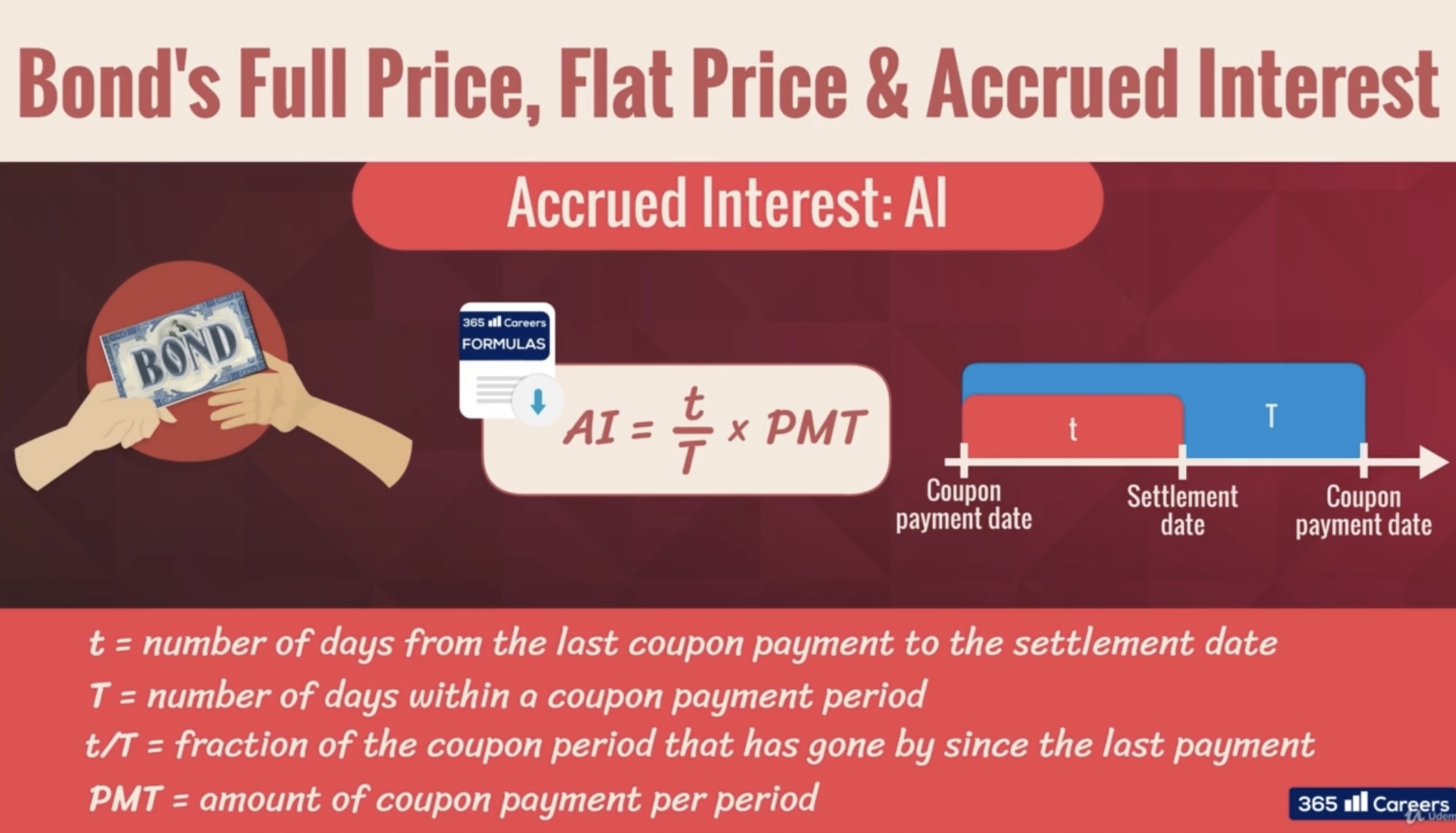

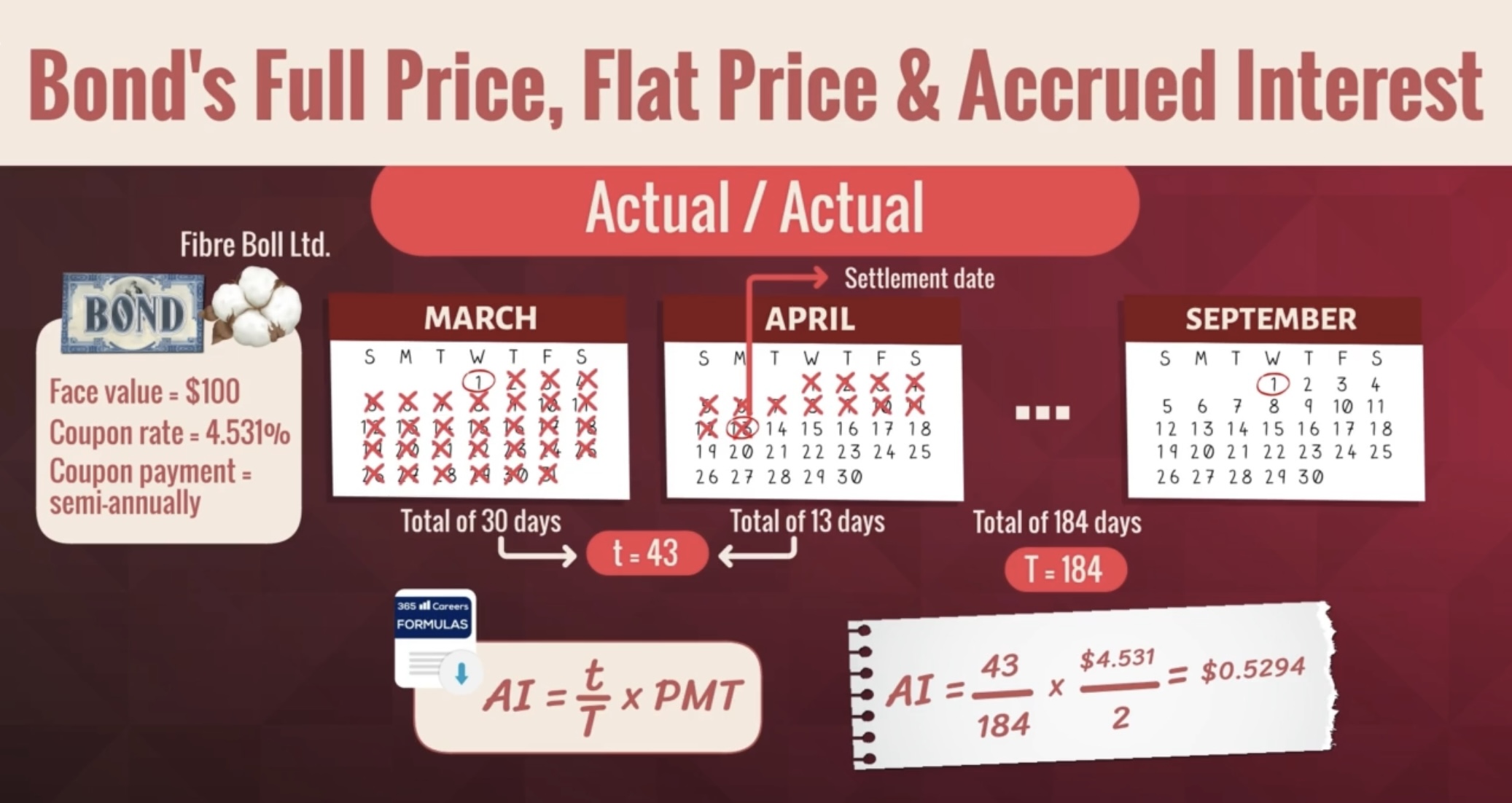

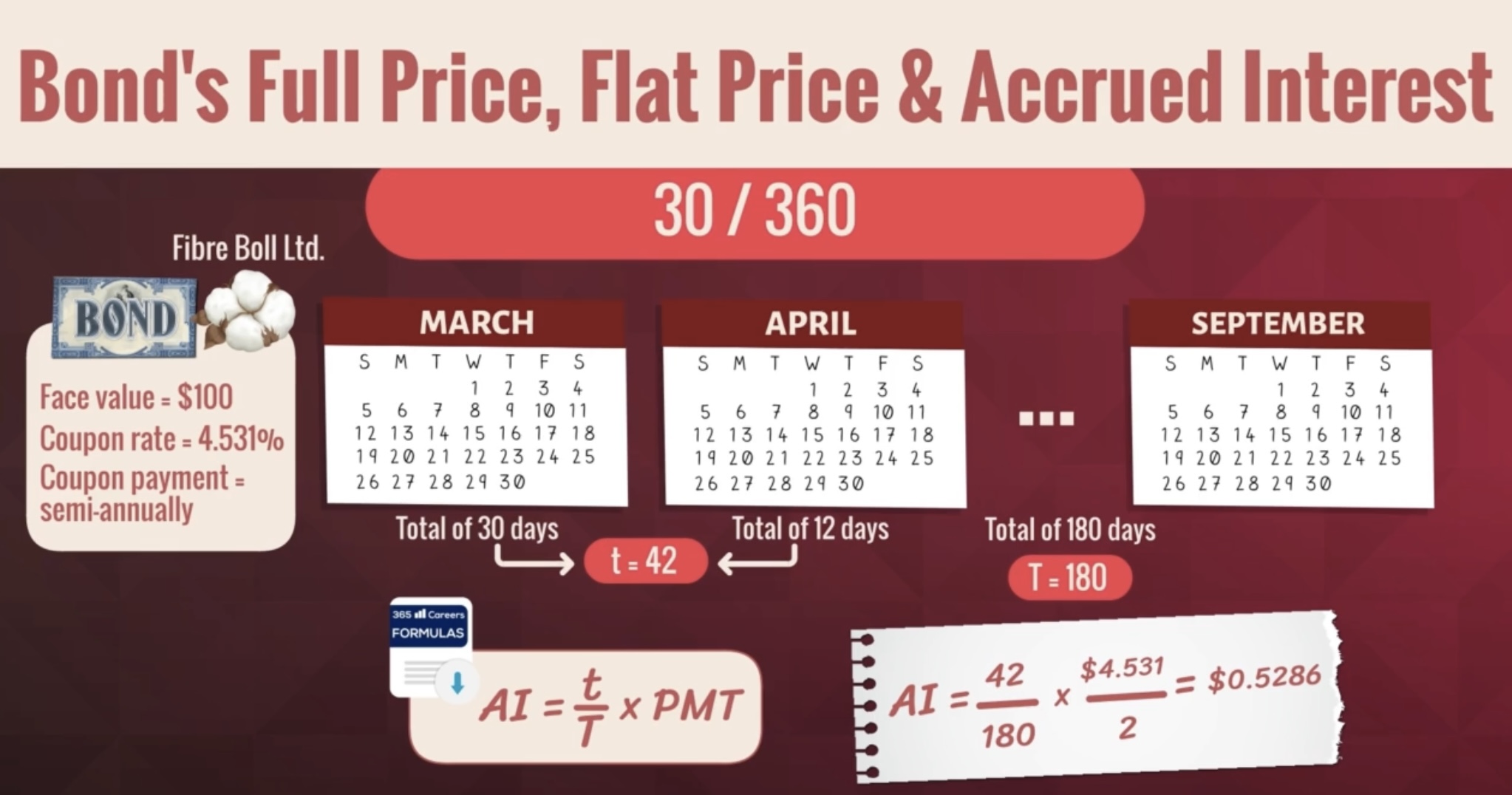

Accrued interest

Accrued interest calculation

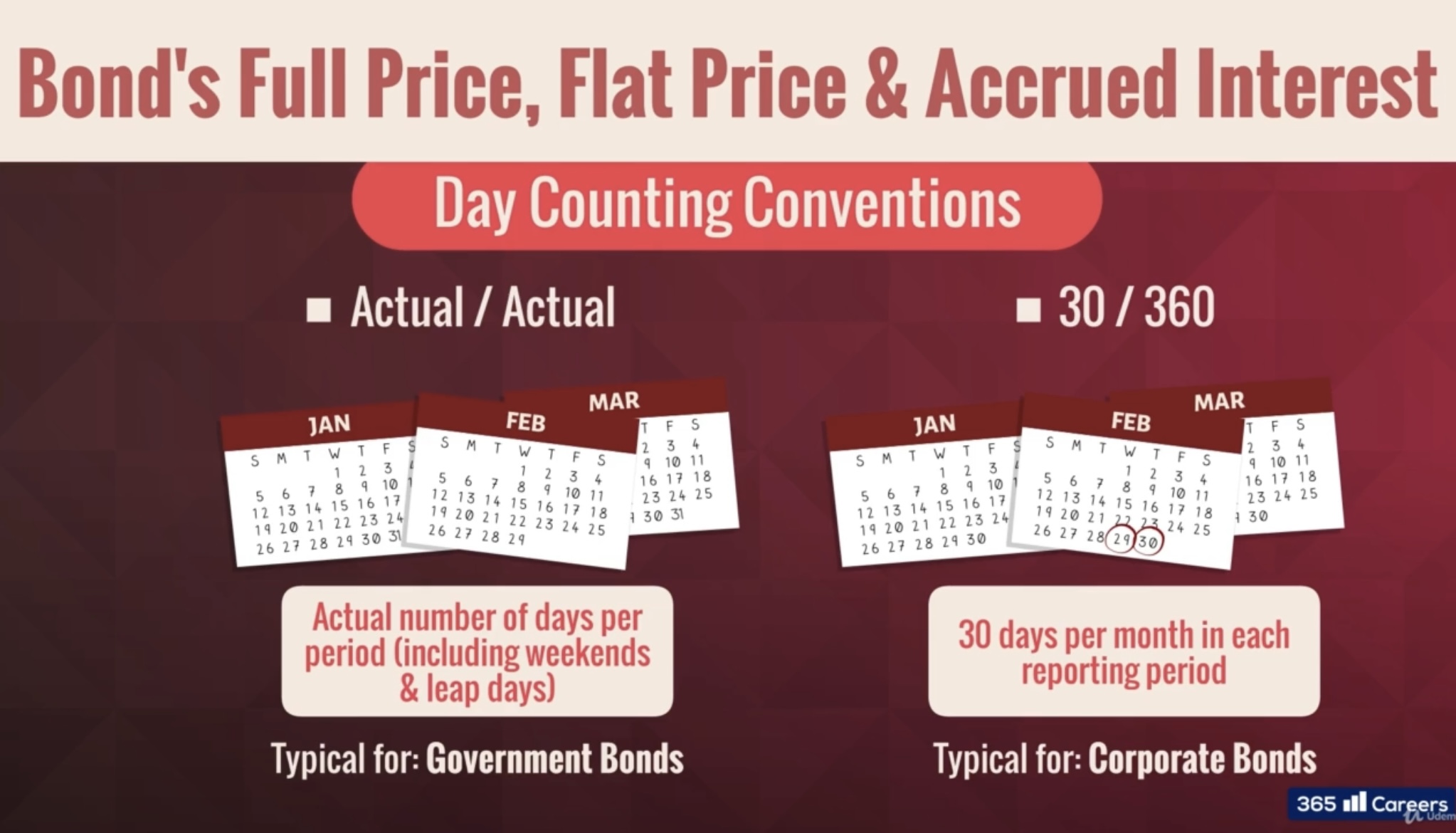

Day counting conventions:

- Actual / Actual (typical for government bonds)

Actual number of days per period (including weekends & leap days)

- 30 / 360 (typical for corporate bonds)

30 days per month in each reporting period

Pricing of bonds

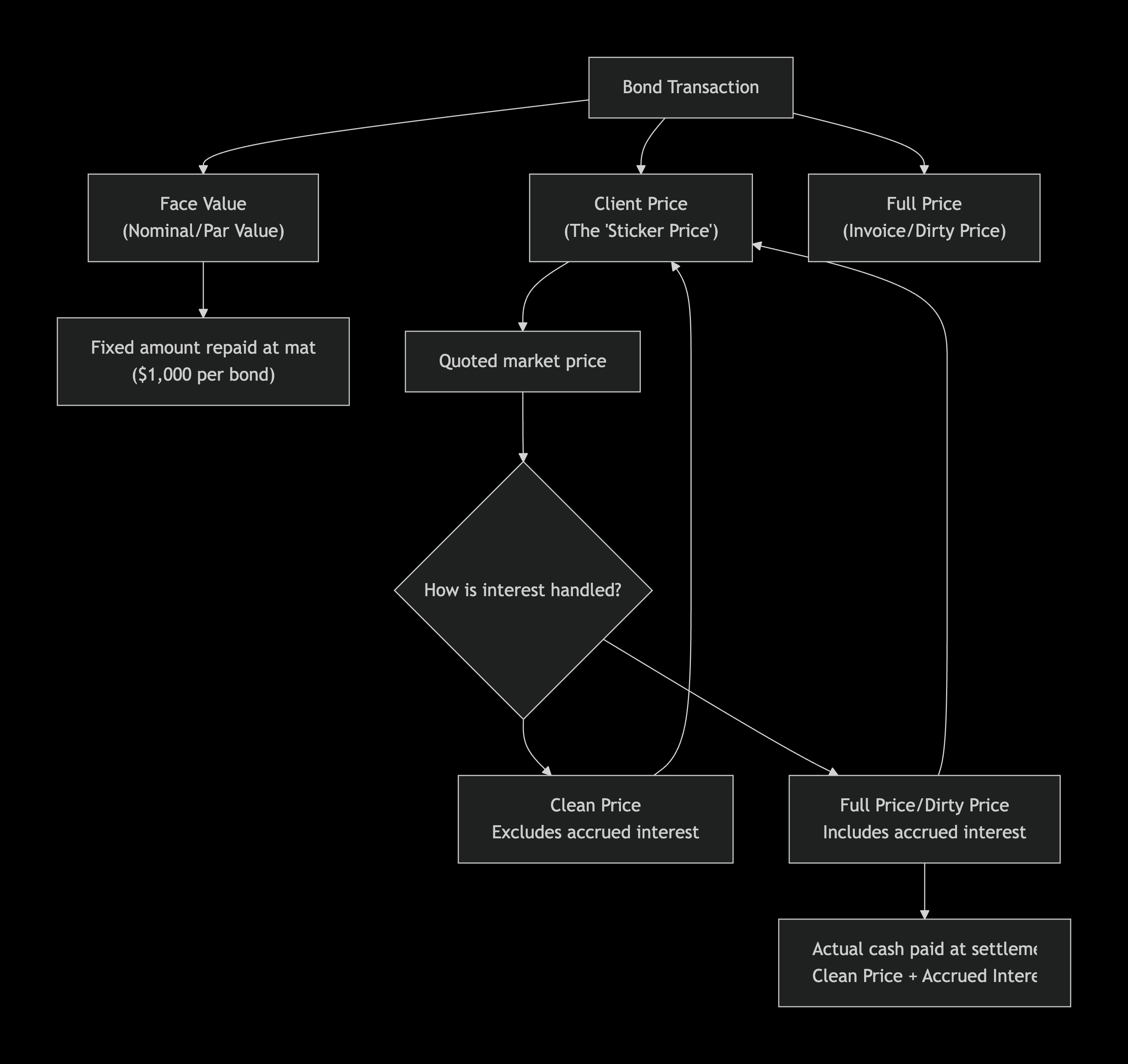

- Nominal value vs Client price

-

Nominal Value (also Face Value or Par Value): A fixed, legal number printed on the bond certificate. It's the amount the issuer promises to repay the holder at maturity. It's also the basis for calculating interest payments (coupons).

-

Client Price: The actual, market-driven amount the investor pays to buy the bond in the secondary market today. It is almost always quoted as a percentage of the nominal value.

In short: Nominal Value is what you get back at the end . Client Price is what you pay to get it now. They are rarely the same number.

- Full price / Dirty price (全价) vs Flat price / Clean price (净价)

Full price = Clean price + Accrued interest

Clean price 是债券市场报价,变动随市场波动,如利率、供需变化。

Accrued interest 由债券面值、息票率与持有时间决定,不随 clean price 变化。

- Bonds are not at all like stock. Although you can buy a share of IBM from any broker, all dealers do not have access to the same bonds. Discount brokers, for example, rarely carry deep inventories of bonds. Moreover, the price of a bond varies from dealer to dealer. Although stock prices are public and easily available, bond prices are not. Bond dealers carefully protect their pricing information as part of their competitive advantage.

债券完全不同于股票。虽然你可以从任何经纪商那里购买 IBM 股票,但并非所有交易商都能获得相同的债券。例如,折扣券商很少持有大量债券库存。此外,债券的价格因经销商而异。虽然股票价格是公开且易于获取的,但债券价格却不是。债券经销商会谨慎保护其定价信息,以获得竞争优势。

Measuring the yield

YTM

https://www.bondsupermart.com/bsm/bond-calculator

Key Formula:

Yield-to-Maturity (YTM) ≈ (Annual Coupon + (Nominal Value - Client Price) / Years to Maturity) / ((Nominal Value + Client Price)/2)

This formula shows that yield is driven by both the coupon (fixed) and the difference between Nominal Value and Client Price.

Fixed vs Floating Rate Bonds | 固定利率 vs 浮动利率债券

Core Concepts | 核心概念

Fixed Rate Bonds | 固定利率债券

-

Interest rate is locked in for the bond's entire life | 利率在债券整个存续期内锁定不变

-

Coupon payments are predictable and constant | 利息支付可预测且恒定

-

Issuer bears interest rate risk | 发行人承担利率风险

Floating Rate Notes (FRNs) | 浮动利率债券

-

Interest rate resets periodically based on a reference benchmark plus spread | 利率定期重设,基于基准利率加利差

-

Coupon payments change with market rates | 利息支付随市场利率变化

-

Investor bears interest rate risk | 投资者承担利率风险

Fixed Rate Bonds Explained | 固定利率债券详解

How They Work | 工作原理

text

Fixed Rate Bond Example | 固定利率债券示例:

Issuance: 5% coupon, $1,000 face, 5-year maturity

┌─────────────────────────────────────┐

│ Year 1: $50 coupon (5% of $1,000)│

│ Year 2: $50 coupon │

│ Year 3: $50 coupon │

│ Year 4: $50 coupon │

│ Year 5: $50 coupon + $1,000 principal

└─────────────────────────────────────┘Completely predictable payments, stable budget for issuer

利息支付完全可预测,发行人预算稳定

Pros & Cons | 优点与缺点

| Advantages | Disadvantages | 优点 | 缺点 |

|---|---|---|---|

| Predictable cash flows for planning | Interest rate risk: Price falls when rates rise | 现金流可预测,便于规划 | 利率风险高:利率上升时价格下跌 |

| Simple long-term planning | Reinvestment risk: Coupons may reinvest at lower rates | 长期规划简单 | 再投资风险:票息可能以更低利率再投资 |

| Easy to understand and value | Inflation risk: Fixed payments lose purchasing power | 易于理解和估值 | 通胀风险:固定支付购买力可能下降 |

| Usually higher initial yield | Less flexibility if rates decline | 通常初始收益率更高 | 缺乏灵活性:利率下降时发行人无法受益 |

Floating Rate Notes Explained | 浮动利率债券详解

Reset Mechanism | 利率重设机制

text

Quarterly Reset FRN Example | 季度重设FRN示例:

Terms: 3-month SOFR + 1.50%, quarterly reset

┌─────────────────────────────────────────────┐

│ Reset Date Jan 1: 3-month SOFR = 5.25% │

│ Q1 Coupon: (5.25% + 1.50%)/4 = 1.6875% │

│ Reset Date Apr 1: 3-month SOFR = 5.50% │

│ Q2 Coupon: (5.50% + 1.50%)/4 = 1.7500% │

│ Reset Date Jul 1: 3-month SOFR = 5.00% │

│ Q3 Coupon: (5.00% + 1.50%)/4 = 1.6250% │

└─────────────────────────────────────────────┘

Interest fluctuates with market rates, price stays near par

利息随市场利率波动,价格保持接近面值Special Features | 特殊条款

-

Caps/Floors : Maximum/minimum coupon rates | 利率上限/下限:最高/最低票息限制

-

Inverse Floaters : Coupon moves opposite to reference rate | 反向浮动债券:票息与基准利率反向变动

-

Range Notes : Only pay interest if reference rate stays within a band | 区间债券:基准利率在特定区间内才支付利息

Pros & Cons | 优点与缺点

| Advantages | Disadvantages | 优点 | 缺点 |

|---|---|---|---|

| Interest rate protection: Price stability | Unpredictable cash flows, budgeting difficulty | 利率保护:利率变化时价格稳定 | 现金流不可预测,预算困难 |

| Low price volatility, trades near par | Credit spread risk: Spread may widen | 价格波动低,接近面值交易 | 信用利差风险:利差可能扩大 |

| Inflation hedge: Coupons rise with rates | Complex valuation: Requires rate forecasting | 通胀对冲:票息随利率上升 | 估值复杂,需要利率预测 |

| Good liquidity, usually trades near par | Lower initial yield than comparable fixed bonds | 流动性好,通常接近面值交易 | 初始收益率通常较低 |

Comparative Summary | 对比总结

| Feature | Fixed Rate Bonds | Floating Rate Notes | 特征 | 固定利率债券 | 浮动利率债券 |

|---|---|---|---|---|---|

| Coupon Payment | Constant | Changes with reference rate | 票息支付 | 固定不变 | 随基准利率变化 |

| Price Sensitivity | High (duration risk) | Low (near par) | 价格敏感性 | 高(久期风险大) | 低(接近面值) |

| Inflation Protection | Poor | Good | 通胀保护 | 差 | 好 |

| Interest Rate Risk Bearer | Investor | Issuer (via coupon reset) | 利率风险承担者 | 投资者 | 发行人(通过票息调整) |

| Cash Flow Predictability | Excellent | Poor | 现金流可预测性 | 优秀 | 差 |

| Typical Investors | Pension funds, retirees | Money market funds, banks | 典型投资者 | 养老金、退休基金 | 货币基金、银行 |

| Primary Use Cases | Liability matching, stable income | Cash management, rising rate environments | 主要用途 | 负债匹配、稳定收入 | 现金管理、利率上升环境 |

| Valuation Complexity | Straightforward | Complex (rate forecasting needed) | 估值难度 | 简单直接 | 复杂(需利率预测) |

Performance in Different Rate Environments | 不同利率环境下的表现

Scenario: Central Bank Hikes Rates 2% | 场景:央行加息2%

Fixed Rate Bond:

-

Immediate price drop as fixed coupon becomes less attractive | 价格立即下跌,因为固定票息吸引力下降

-

Longer maturity = larger price decline | 期限越长,跌幅越大

-

Gradual recovery as bond approaches maturity ("pull to par") | 随着临近到期逐步恢复("回归面值")

Floating Rate Note:

-

Minimal price movement | 价格基本不变

-

Coupon resets higher, maintaining near-par value | 票息重设上调,保持接近面值

-

Small price changes due to credit spread adjustments only | 仅因信用利差变化有小幅价格波动

Price Movement Visualization | 价格变化可视化

Selection Guide | 选择指南

Choose FIXED RATE when: | 选择固定利率当:

-

You need predictable income (retirees, endowment funds) | 需要可预测收入(退休人士、捐赠基金)

-

You expect rates to fall or stay stable | 预期利率下降或保持稳定

-

You're matching fixed liabilities (insurance companies) | 匹配固定负债(保险公司)

-

You want to lock in attractive long-term yields | 希望锁定有吸引力的长期收益率

-

You're investing for the long term and can ride out price volatility | 长期投资并能承受价格波动

Choose FLOATING RATE when: | 选择浮动利率当:

-

You expect interest rates to rise | 预期利率上升

-

You need principal stability (cash-like investment) | 需要本金稳定(类现金投资)

-

You have short-term horizons (< 3 years) | 投资期限短(< 3年)

-

You're concerned about inflation | 担心通胀风险

-

You're a financial institution managing rate-sensitive assets | 金融机构管理利率敏感资产

Investment Strategy Implications | 投资策略应用

Ladder Strategy with Mix | 混合阶梯策略

text

Conservative Portfolio Mix | 保守型投资组合配置:

┌─────────────────────────────────────────┐

│ Short-term: FRNs (40%) │

│ Intermediate: Fixed/Floating Blend (30%)│

│ Long-term: Fixed Rate Bonds (30%) │

└─────────────────────────────────────────┘

Benefits: Liquidity + Stability + Yield

优势:流动性 + 稳定性 + 收益率结合Active Positioning Strategies | 主动管理策略

-

Barbell Approach : Combine very short FRNs with long fixed bonds | 杠铃策略:结合超短期FRN和长期固定债券

-

Bullet Strategy : Concentrate in specific maturities based on rate view | 子弹策略:基于利率观点集中在特定期限

-

Rolling Down the Curve : Buy fixed bonds when yield curve is steep | 滑落曲线策略:收益率曲线陡峭时买入固定债券

Market Context & Trends | 市场背景与趋势

Historical Perspective | 历史视角:

-

1980s-2000s: Falling rates favored fixed bonds (big capital gains) | 利率下降利好固定债券(资本利得大)

-

2008-2021: Ultra-low rates made floaters less attractive (SOFR near zero) | 超低利率使浮动债券吸引力下降(SOFR接近零)

-

2022-Present: Rapid rate hikes made FRNs popular again | 快速加息使FRN再度受欢迎

Current Considerations | 当前考虑因素:

-

SOFR Transition : LIBOR replacement changed floating rate mechanics | SOFR转型:LIBOR替代改变了浮动利率机制

-

Inverted Yield Curve : Affects economics of FRNs vs fixed bonds | 收益率曲线倒挂:影响FRN与固定债券的经济性

-

Central Bank Uncertainty : Makes floaters attractive for rate flexibility | 央行政策不确定性:使浮动债券因利率灵活性而具吸引力

Key Takeaways | 关键要点

-

Fixed = Rate Risk, Float = Spread Risk

-

Fixed bonds suffer when rates rise | 固定债券在利率上升时受损

-

Floaters suffer when credit spreads widen | 浮动债券在信用利差扩大时受损

-

-

Duration Difference is Critical

-

Fixed bonds have meaningful duration | 固定债券有显著久期

-

FRNs have near-zero duration (except between reset dates) | FRN久期接近零(除重设日之间)

-

-

The "Breakeven Rate Change" Matters

-

Calculate how much rates must rise for FRNs to outperform fixed bonds | 计算利率需上升多少FRN才能跑赢固定债券

-

Formula:

Breakeven = (Fixed Yield - FRN Initial Yield) / Fixed Bond Duration| 公式:盈亏平衡 = (固定收益率 - FRN初始收益率) / 固定债券久期

-

-

Credit Quality Interacts

-

Lower-rated issuers: Floaters may be better (investors demand rate protection) | 低评级发行人:浮动债券可能更好(投资者要求利率保护)

-

Higher-rated issuers: Fixed often preferred (investors want yield certainty) | 高评级发行人:通常偏好固定债券(投资者需要收益率确定性)

-

Bottom Line | 核心结论:

The choice depends on your interest rate outlook, cash flow needs, and risk tolerance. Many investors use a blend in uncertain environments. | 选择取决于利率预期、现金流需求和风险承受能力。在不确定环境下,许多投资者采用混合策略。

《The Bond Book》(Author: Annette Thau) Note 笔记

Bonds Defined 债券定义

A bond is a debt. A government, company or other entity borrows money and promises to repay it. The promise is in writing, and that written promise is a bond. The promise will usually commit the borrower to repay the principal and also to pay interest at some defined rate. It is that simple. When companies borrow capital in the bond markets, they are said to "issue" bonds.

债券就是债务。政府、公司或其他实体借款并承诺偿还。承诺是书面的,而书面承诺就是一种纽带。该承诺通常会让借款人承诺偿还本金,并按规定利率支付利息。就是这么简单。当公司在债券市场借入资本时,被称为"发行"债券。

Bond Vocabulary 债券词汇

Bond investors should know these terms:

债券投资者应了解以下术语:

-

Indenture -- The legal agreement between the issuer and the buyer of the bond. It stipulates dates when interest and principal payments are due, how the issuer will pay the debt, redemption terms and conditions, and other particulars.

契约------债券发行人与买方之间的法律协议。它规定了利息和本金的到期日期、发行人如何偿还债务、赎回条款及其他细节。

-

Prospectus -- A brief summary of the most important points in the indenture.

招股说明书------对契约中最重要的要点的简要总结。 -

Official statement (O/S) -- This phrase is used to refer to the prospectus after the bond has been sold. Before the bond is sold, the prospectus may be called a red herring, because of some legal terms printed in red on the cover.

官方声明(O/S)------此短语用于指债券售出后的招股说明书。在债券出售前,招股说明书可能被称为误导,因为封面上印有红色法律术语。 -

Treasuries -- Bonds issued by the U.S. government or its agencies.

国债------由美国政府或其机构发行的债券。 -

Corporates -- Bonds issued by corporations.

公司债券------由公司发行的债券。 -

Municipals -- Bonds issued by cities, states and other local government units.

市政债券------由城市、州及其他地方政府单位发行的债券。

When you buy or sell bonds, you will come across these terms:

当您买卖债券时,您会遇到以下术语:

-

Par -- What a bond is worth at maturity, usually $1,000.

面值------债券到期时的价值,通常为1000美元。

-

Discount -- A bond that sells for less than par sells at a discount.

折扣------低于面值的债券以折扣价出售。

-

Premium -- A bond that sells for more than par value sells at a premium.

溢价------高于面值的债券以溢价出售。

-

CUSIP Number -- A nine-digit identifying number for a bond, similar to a stock's symbol. CUSIP stands for Committee on Uniform Security Identification Procedures.

CUSIP 编号------债券的九位数字识别码,类似于股票的代码。CUSIP 代表统一安全识别程序委员会。

-

Bid -- The price you will receive if you sell a bond.

出价------如果你卖出债券,你将获得的价格。

-

Ask -- The price you will pay if you buy a bond.

问价------如果你买入债券,你将要付出的价格。

-

Spread -- The difference between the bid and the ask; think of it as a commission for the bond dealer.

价差------买卖价与卖价之间的差额;可以把它看作是债券交易商的佣金。

-

Coupon -- The bond's interest rate.

票券------债券的利率。

-

Accrued interest -- Bonds pay interest twice a year. If you buy a bond between interest payments, you will not receive interest payments for the time that you did not own the bond. You will have to pay the dealer that accrued interest.

应计利息------债券每年支付两次利息。如果您在支付利息之间购买债券,您将无法获得您未持有债券期间的利息支付。你必须支付经销商那笔累计利息。

-

Call risk -- The risk that the bond issuer will pay the bond before maturity. Buyers who pay a premium for a bond may lose principal if the issuer "calls" the bond.

回购风险------债券发行人在到期前偿还债券的风险。如果发行人"认购"债券,买方支付溢价可能会损失本金。

-

Yield to call -- The yield you can expect to earn before the bond is called.

赎回收益率------债券被赎回前你预期获得的收益率。

-

Basis point -- One one-hundredth of a percentage point.

基点------百分之一百个百分点。

-

Total return -- The sum of what you earn from a bond, both in interest (simple and compound) and in any principal gains or losses from fluctuating interest rates.

总回报------你从债券中获得的总和,包括利息(简单和复利)以及因利率波动带来的本金盈亏。

-

Duration -- A measure of how much the price of a bond will rise or fall when interest rates move. The longer the duration, the more volatile the price of the bond.

久期------衡量利率波动时债券价格涨跌幅度的指标。期限越长,债券价格波动越大。

There are three important kinds of yield:

-

Coupon yield 票息收益率 -- This is the bond's coupon rate.

票息收益率------这是债券的票面利率。 -

Current yield -- The bond's coupon payment divided by its price. If you pay 1,000 par value for a bond with a 100 coupon, your current yield is 10%. If you pay a premium and buy it for 1,200, the current yield is only 8.33%. If you buy it at a discount for 800, the current yield is 12.5%.

当前收益率------债券的票息支付除以其价格。如果你为一张面值1000美元的债券支付1000美元,你的当前收益率是10%。如果你支付溢价并以1200美元买入,当前收益率仅为8.33%。如果你以800美元折扣价购买,当前收益率是12.5%。

-

Yield-to-maturity (YTM) -- This figure expresses in percentage terms all that you will earn over the entire life of the bond.

到期收益率(YTM)------此数字以百分比表示您在整个债券存续期间将获得的收益。

Other bond variations include:

其他键合变体包括:

-

Zero coupon bonds -- These bonds do not pay a coupon. Dealers create them by splitting the interest and the principal of a Treasury security into two payment streams. The buyer pays much less than par for the security, but receives the whole par principal payment at maturity. The final payment represents a compounded return. The disadvantages are, first, that zeros can be expensive, and second, that you must pay taxes on the zero's annual accrued interest even though you do not get the interest until the bond matures. Therefore, zeroes make the most sense in a tax-sheltered account.

零息债券------这些债券不支付息息。交易商通过将国库证券的利息和本金分成两条支付渠道来创造这些债券。买方支付的金额远低于面值,但在到期时获得全部面值本金。最终付款代表复利回报。缺点是,首先,零利率可能较高;其次,即使债券到期后你才会收到利息,但你仍需对零的年度应计利息缴纳税款。因此,零在避税账户中最有意义。

-

Municipal bonds -- Municipal securities are exempt from federal tax and may also be exempt from state and local taxes. This sounds appealing, but people in low tax brackets should sharpen their pencils before they buy. It might make better economic sense for them to buy taxable bonds and pay the tax. The interest rate on municipal bonds is lower than that of taxable bonds, and the relative economic value of the tax exemption depends on your tax bracket. Municipal bonds, unlike Treasuries, do have credit risk. They may also be callable.

市政债券------市政证券免联邦税,也可能免征州和地方税。这听起来很吸引人,但低税率的人购买前应该先磨好铅笔。他们购买应税债券并缴纳税款可能更经济合理。市政债券的利率低于应税债券,免税额的相对经济价值取决于你的税率等级。市政债券与国债不同,确实存在信用风险。他们也可能被叫到。

-

Bond mutual funds -- For most people, mutual funds may be the best way to invest in corporate bonds or other instruments, such as mortgage-backed securities. Mutual funds reduce your cost of buying or selling bonds because, as a shareholder in an institution, you effectively get the benefit of low, institutional trading costs. Mutual funds also make it easy to get the benefit of diversification, as important a consideration with bonds as with stocks. Many different bond mutual funds are available. To reduce your costs, seek no-load funds and funds with low expense ratios. Read the prospectus with particular attention to risk. If a fund is earning much higher rates of return than its competitors, beware. High returns usually imply high risk!

债券共同基金------对大多数人来说,共同基金可能是投资企业债券或其他工具(如抵押贷款支持证券)的最佳方式。共同基金降低了你买卖债券的成本,因为作为机构股东,你实际上享受到了低机构交易成本的好处。共同基金也使得实现多元化的好处变得容易,这在债券和股票中同样重要。市面上有许多不同的债券共同基金可供选择。为了降低成本,选择无负荷基金和低费用比率的基金。阅读招股说明书时,特别注意风险。如果某个基金的收益率远高于竞争对手,请保持警惕。高回报通常意味着高风险!

Take-Aways

- Bond issuers do not sell directly to the public; investment banks buy the bonds from the issuers and then resell them to investors.

债券发行人不直接向公众出售;投资银行从发行人手中购买债券,然后再转售给投资者。

- When interest rates rise, the bond's value falls; when interest rates fall, the value rises.

当利率上升时,债券价值下降;利率下降时,价值会上升。

- Evaluate a bond's yield-to-maturity and duration. Assess rates and risk.

评估债券的到期收益率和存续期限。评估费率和风险。

- Treasury securities are the safest, most liquid and sometimes the lowest cost bond investments available to the individual investor.

国债是个人投资者可获得的最安全、流动性最高,有时也是成本最低的债券投资。

- Never invest in any bond or bond fund that you do not understand fully.

切勿投资任何你不完全理解的债券或债券基金。

- "Invest between 40% and 60% of your assets in stocks because of their historically higher return than bonds. Put the rest in bonds and cash."

"将40%到60%的资产投资于股票,因为它们的回报率历史上高于债券。剩下的都押成债券和现金。"

- "If you are risk-averse, for most of your bond portfolio, two-to-five year Treasuries and five-to-ten-year munis will provide the best combination of risk and return."

"如果你是风险厌恶者,对于大部分债券组合,二到五年期国债和五到十年期市政债券将提供风险与回报的最佳组合。"

Where to trade

The bond market is not a single place. Bonds come from many companies, agencies and institutions worldwide; some of them are specialized, some are not. Some bonds sell on organized exchanges, but most go directly from dealer to dealer in the over-the-counter (OTC) market. Even the biggest individual investor is a little buyer in the bond market. Most individuals lack the mathematical sophistication, capital and information to trade bonds successfully. Individuals also pay higher commissions and fees because of the small size of their trades and the smaller overall level of business they represent. Individuals can buy from banks, from full service or discount brokerages or, in the case of Treasuries, directly from the Federal Reserve Bank.

债券市场不是单一的地方。债券来自全球众多公司、机构和机构;有些是专门的,有些则不是。一些债券在有组织的交易所出售,但大多数是场外交易(OTC)市场中直接从交易商转售到交易商。即使是最大的个人投资者,在债券市场中也只是小买家。大多数人缺乏成功的债券交易所需的数学能力、资本和信息。由于个人的行业规模较小且所代表的业务规模较小,个人支付的佣金和费用也较高。个人可以从银行、全方位服务券商或折扣券商购买,或者在国债方面直接向联邦储备银行购买。

Risk

- Interest Rate Risk | 利率风险

Bond investors also encounter interest rate risk. Suppose that a bond pays a fixed interest rate of 5%. As long as the prevailing interest rate for similar securities is 5%, the bond will sell at or near par. But what if interest rates suddenly double to 10%? If investors can spend 1,000 for a bond that pays 10%, they are unlikely to pay you 1,000 for a bond that pays only 5%. They will insist on earning 10%. If you want to sell the bond, you will have to sell it at a discount. On the other hand, if interest rates suddenly fall to 2%, you would refuse to sell someone your 5% bond for its par value. You would demand much more and would sell the bond at a premium.

债券投资者还面临利率风险。假设一只债券支付5%的固定利率。只要类似证券的现行利率为5%,债券就会以面值或接近面值出售。但如果利率突然翻倍到10%呢?如果投资者能为一只回报10%的债券花1000美元,那么他们不太可能为只支付5%的债券支付1000美元。他们会坚持要赚10%。如果你想卖出债券,必须以折扣价出售。另一方面,如果利率突然降到2%,你会拒绝以面值出售你5%债券。你会要求更高的价格,并且会以溢价出售债券。

- Credit/Default Risk | 信用/违约风险

- Liquidity Risk | 流动性风险

- Reinvestment Risk | 再投资风险

- Inflation/Purchasing Power Risk | 通胀/购买力风险

- Call/Prepayment Risk | 赎回/提前偿还风险

- Currency/Exchange Rate Risk | 货币/汇率风险

- Sovereign/Country Risk | 主权/国家风险

- Event Risk | 事件风险