文章目录

- [3. Comptroller - Compound的⻛控中枢](#3. Comptroller - Compound的⻛控中枢)

-

- [3.1 Comptroller核⼼职责](#3.1 Comptroller核⼼职责)

- [3.2 账户流动性计算](#3.2 账户流动性计算)

- [4. 利率模型详解](#4. 利率模型详解)

-

- [4.1 JumpRateModel - 跳跃利率模型](#4.1 JumpRateModel - 跳跃利率模型)

-

- [4.1.1 利率模型原理](#4.1.1 利率模型原理)

- [4.1.2 利率曲线可视化](#4.1.2 利率曲线可视化)

- [4.1.3 利率模型合约实现](#4.1.3 利率模型合约实现)

- [4.2 利率实时更新机制](#4.2 利率实时更新机制)

- [5. Compound V3 (Comet) - 新⼀代架构](#5. Compound V3 (Comet) - 新⼀代架构)

-

- [5.1 为什么需要V3?](#5.1 为什么需要V3?)

- [5.2 Comet核⼼设计](#5.2 Comet核⼼设计)

-

- [5.2.1 V2 vs V3 架构对⽐](#5.2.1 V2 vs V3 架构对⽐)

- [5.2.2 Comet核⼼合约](#5.2.2 Comet核⼼合约)

- [5.3 Comet的优势](#5.3 Comet的优势)

3. Comptroller - Compound的⻛控中枢

3.1 Comptroller核⼼职责

Comptroller是Compound协议的"⼤脑",负责所有⻛险控制和市场管理功能。它的核⼼职责包括:

- 市场准⼊控制:决定哪些资产可以作为抵押品

- 借款额度计算:实时计算⽤户的借款能⼒

- 清算判定:判断账户是否可以被清算

- ⻛险参数管理:设置和更新各种⻛险参数

- COMP奖励分发:管理流动性挖矿奖励

3.2 账户流动性计算

流动性计算是Comptroller最核⼼的功能,决定了⽤户能否借款、是否会被清算。

c

// Comptroller.sol - 账户流动性计算

contract Comptroller {

/**

* @notice 计算账户流动性

* @param account 账户地址

* @return (error, liquidity, shortfall)

*/

function getAccountLiquidity(address account)

public

view

returns (uint, uint, uint)

{

// 获取账户在所有市场的资产和负债

(uint err, uint liquidity, uint shortfall) =

getHypotheticalAccountLiquidityInternal(

account,

CToken(address(0)),

0,

0

);

return (err, liquidity, shortfall);

}

/**

* @notice 内部流动性计算函数

* @dev 核⼼算法:遍历所有市场,累加抵押品和债务

*/

function getHypotheticalAccountLiquidityInternal(

address account,

CToken cTokenModify,

uint redeemTokens,

uint borrowAmount

) internal view returns (uint, uint, uint) {

// 累加变量

uint sumCollateral = 0; // 总抵押品价值(加权)

uint sumBorrowPlusEffects = 0; // 总债务价值

// 遍历⽤户参与的所有市场

CToken[] memory assets = accountAssets[account];

for (uint i = 0; i < assets.length; i++) {

CToken asset = assets[i];

// 获取⽤户在该市场的cToken余额

uint cTokenBalance = asset.balanceOf(account);

// 获取汇率和价格

uint exchangeRate = asset.exchangeRateStored();

uint oraclePrice = oracle.getUnderlyingPrice(asset);

// 获取市场配置

(, uint collateralFactorMantissa) = markets[address(asset)];

// 计算该资产的抵押品价值

// tokenValue = cTokenBalance × exchangeRate × price

uint tokensToDenom = (cTokenBalance * exchangeRate) / 1e18;

uint collateralValue = (tokensToDenom * oraclePrice) / 1e18;

// 如果该资产启⽤了抵押,累加到总抵押品

if (collateralFactorMantissa > 0) {

sumCollateral += (collateralValue * collateralFactorMantissa) / 1e18;

}

// 计算该资产的借款价值

uint borrowBalance = asset.borrowBalanceStored(account);

uint borrowValue = (borrowBalance * oraclePrice) / 1e18;

sumBorrowPlusEffects += borrowValue;

// 如果是假设性操作,调整计算

if (asset == cTokenModify) {

// 假设赎回

if (redeemTokens > 0) {

uint redeemValue = (redeemTokens * exchangeRate * oraclePrice) / (1e18 * 1e18);

sumCollateral -= (redeemValue * collateralFactorMantissa) / 1e18;

}

// 假设借款

if (borrowAmount > 0) {

uint borrowValue = (borrowAmount * oraclePrice) / 1e18;

sumBorrowPlusEffects += borrowValue;

}

}

}

// 计算流动性和资⾦缺⼝

if (sumCollateral > sumBorrowPlusEffects) {

return (0, sumCollateral - sumBorrowPlusEffects, 0);

} else {

return (0, 0, sumBorrowPlusEffects - sumCollateral);

}

}

/**

* @notice 检查是否允许借款

*/

function borrowAllowed(

address cToken,

address borrower,

uint borrowAmount

) external returns (uint) {

// 1. 检查市场是否上线

if (!markets[cToken].isListed) {

return uint(Error.MARKET_NOT_LISTED);

}

// 2. 检查借款上限

if (!markets[cToken].accountMembership[borrower]) {

// 如果⽤户⾸次借款,⾃动加⼊市场

markets[cToken].accountMembership[borrower] = true;

accountAssets[borrower].push(CToken(cToken));

}

// 3. 计算假设性的账户流动性

(uint err, , uint shortfall) = getHypotheticalAccountLiquidityInternal(

borrower,

CToken(cToken),

0,

borrowAmount

);

if (err != 0) {

return err;

}

// 如果会产⽣资⾦缺⼝,拒绝借款

if (shortfall > 0) {

return uint(Error.INSUFFICIENT_LIQUIDITY);

}

return uint(Error.NO_ERROR);

}

/**

* @notice 检查是否允许赎回

*/

function redeemAllowed(

address cToken,

address redeemer,

uint redeemTokens

) external returns (uint) {

// 检查赎回后是否会产⽣资⾦缺⼝

(uint err, , uint shortfall) = getHypotheticalAccountLiquidityInternal(

redeemer,

CToken(cToken),

redeemTokens,

0

);

if (err != 0) {

return err;

}

if (shortfall > 0) {

return uint(Error.INSUFFICIENT_LIQUIDITY);

}

return uint(Error.NO_ERROR);

}

}3.3 ⻛险参数配置

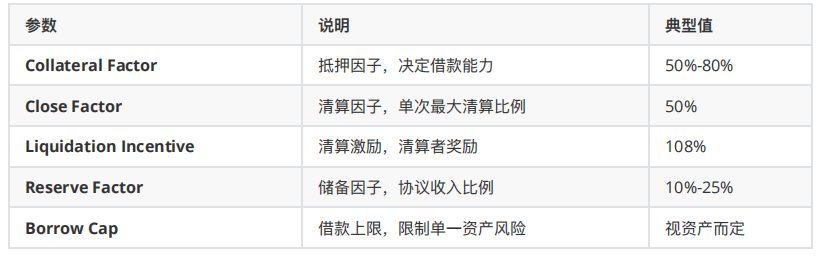

主要⻛险参数:

不同资产的⻛险参数对⽐:

4. 利率模型详解

4.1 JumpRateModel - 跳跃利率模型

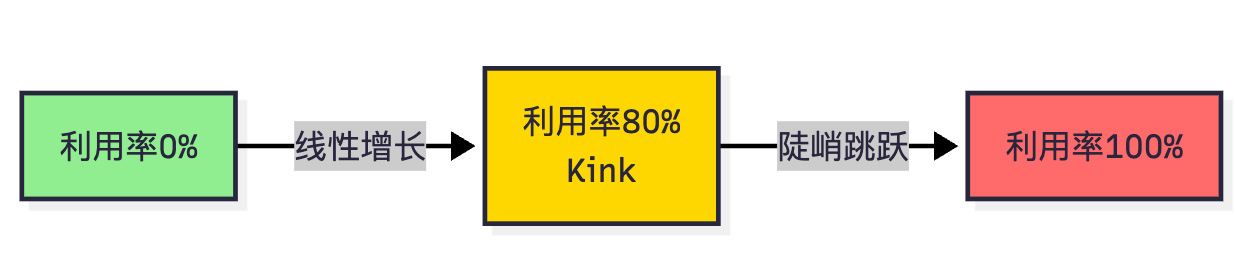

Compound采⽤JumpRateModel(跳跃利率模型),这是⼀种分段线性的利率曲线,在达到最优利⽤率前线性增⻓,超过后陡峭上升。

4.1.1 利率模型原理

核⼼思想:

通过利率调节市场供需,保护资⾦池流动性:

- 利⽤率低时:低利率吸引借款

- 利⽤率适中时:线性增⻓

- 利⽤率过⾼时:利率跳跃,抑制借款

利率计算公式:

利⽤率 U = Borrows / (Cash + Borrows - Reserves)

借款利率:

- 当 U ≤ Kink: BorrowRate = baseRate + multiplier × U

- 当 U > Kink: BorrowRate = baseRate + multiplier × Kink + jumpMultiplier × (U - Kink)

存款利率:SupplyRate = BorrowRate × U × (1 - ReserveFactor)

参数说明:

- baseRate :基础利率(通常为0或很⼩的值)

- multiplier :正常斜率系数

- jumpMultiplier :跳跃斜率系数(远⼤于multiplier)

- Kink :拐点,通常设置为80%

4.1.2 利率曲线可视化

USDC利率曲线示例:

参数配置:

- baseRatePerYear: 0%

- multiplierPerYear: 5%

- jumpMultiplierPerYear: 109%

- kink: 80%

利率计算:U = 50%(正常区间)

borrowAPY = 0% + 5% × (50%/80%) = 3.125%

supplyAPY = 3.125% × 50% × 90% = 1.41%

U = 80%(拐点)borrowAPY = 0% + 5% × 1 = 5%

supplyAPY = 5% × 80% × 90% = 3.6%

U = 90%(⾼利⽤率)borrowAPY = 0% + 5% + 109% × (10%/20%) = 59.5%

supplyAPY = 59.5% × 90% × 90% = 48.2%

U = 95%(接近枯竭)borrowAPY = 0% + 5% + 109% × (15%/20%) = 86.75%

supplyAPY = 86.75% × 95% × 90% = 74.1%

4.1.3 利率模型合约实现

c

// JumpRateModel.sol

pragma solidity ^0.8.10;

/**

* @title JumpRateModel

* @notice 实现分段线性利率模型

*/

contract JumpRateModel {

// ⼀年的区块数(假设12秒⼀个区块)

uint public constant blocksPerYear = 2628000;

// 基础利率(每区块)

uint public baseRatePerBlock;

// 正常斜率乘数(每区块)

uint public multiplierPerBlock;

// 跳跃斜率乘数(每区块)

uint public jumpMultiplierPerBlock;

// 拐点(利⽤率阈值)

uint public kink;

/**

* @notice 构造函数

* @param baseRatePerYear 年化基础利率

* @param multiplierPerYear 年化正常斜率

* @param jumpMultiplierPerYear 年化跳跃斜率

* @param kink_ 拐点

*/

constructor(

uint baseRatePerYear,

uint multiplierPerYear,

uint jumpMultiplierPerYear,

uint kink_

) {

baseRatePerBlock = baseRatePerYear / blocksPerYear;

multiplierPerBlock = multiplierPerYear / blocksPerYear;

jumpMultiplierPerBlock = jumpMultiplierPerYear / blocksPerYear;

kink = kink_;

}

/**

* @notice 计算利⽤率

* @param cash 可⽤现⾦

* @param borrows 总借款

* @param reserves 储备⾦

* @return 利⽤率(scaled by 1e18)

*/

function utilizationRate(

uint cash,

uint borrows,

uint reserves

) public pure returns (uint) {

// 如果没有借款,利⽤率为0

if (borrows == 0) {

return 0;

}

// U = borrows / (cash + borrows - reserves)

return (borrows * 1e18) / (cash + borrows - reserves);

}

/**

* @notice 计算每区块借款利率

* @param cash 可⽤现⾦

* @param borrows 总借款

* @param reserves 储备⾦

* @return 每区块借款利率

*/

function getBorrowRate(

uint cash,

uint borrows,

uint reserves

) public view returns (uint) {

uint util = utilizationRate(cash, borrows, reserves);

// 如果利⽤率 <= kink,使⽤正常斜率

if (util <= kink) {

// rate = base + multiplier × util

return ((util * multiplierPerBlock) / 1e18) + baseRatePerBlock;

} else {

// 如果利⽤率 > kink,使⽤跳跃斜率

// normalRate = base + multiplier × kink

uint normalRate = ((kink * multiplierPerBlock) / 1e18) + baseRatePerBlock;

// excessUtil = util - kink

uint excessUtil = util - kink;

// jumpRate = normalRate + jumpMultiplier × excessUtil

return ((excessUtil * jumpMultiplierPerBlock) / 1e18) + normalRate;

}

}

/**

* @notice 计算每区块存款利率

* @param cash 可⽤现⾦

* @param borrows 总借款

* @param reserves 储备⾦

* @param reserveFactorMantissa 储备因⼦

* @return 每区块存款利率

*/

function getSupplyRate(

uint cash,

uint borrows,

uint reserves,

uint reserveFactorMantissa

) public view returns (uint) {

uint oneMinusReserveFactor = 1e18 - reserveFactorMantissa;

uint borrowRate = getBorrowRate(cash, borrows, reserves);

uint util = utilizationRate(cash, borrows, reserves);

// supplyRate = borrowRate × util × (1 - reserveFactor)

uint rateToPool = (borrowRate * oneMinusReserveFactor) / 1e18;

return (util * rateToPool) / 1e18;

}

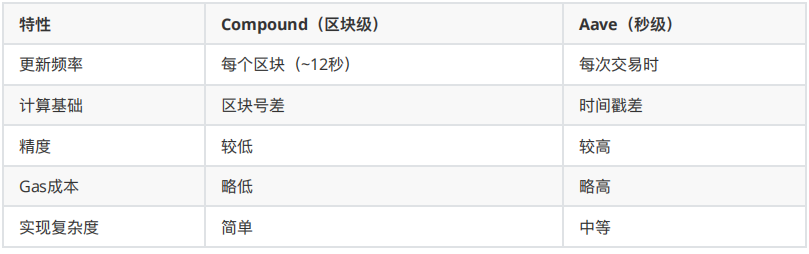

}4.2 利率实时更新机制

区块级利息累积:

Compound的利息在每个区块累积,通过 accrueInterest 函数更新:

c

/**

* @notice 累积利息

* @dev 在任何状态变更操作前都必须调⽤

*/

function accrueInterest() public returns (uint) {

// 1. 获取当前区块号

uint currentBlockNumber = block.number;

uint accrualBlockNumberPrior = accrualBlockNumber;

// 如果在同⼀区块内,⽆需重复计算

if (accrualBlockNumberPrior == currentBlockNumber) {

return uint(Error.NO_ERROR);

}

// 2. 读取存储的状态

uint cashPrior = getCash();

uint borrowsPrior = totalBorrows;

uint reservesPrior = totalReserves;

uint borrowIndexPrior = borrowIndex;

// 3. 计算当前借款利率

uint borrowRateMantissa = interestRateModel.getBorrowRate(

cashPrior,

borrowsPrior,

reservesPrior

);

require(borrowRateMantissa <= borrowRateMaxMantissa, "Borrow rate too high");

// 4. 计算区块差

uint blockDelta = currentBlockNumber - accrualBlockNumberPrior;

// 5. 计算利息

// interestAccumulated = borrowRate × borrows × blockDelta

uint simpleInterestFactor = borrowRateMantissa * blockDelta;

uint interestAccumulated = (simpleInterestFactor * borrowsPrior) / 1e18;

// 6. 更新总借款(加上新增利息)

uint totalBorrowsNew = interestAccumulated + borrowsPrior;

// 7. 更新储备⾦(协议收⼊)

uint totalReservesNew = (interestAccumulated * reserveFactorMantissa) / 1e18 +

reservesPrior;

// 8. 更新借款索引

uint borrowIndexNew = (simpleInterestFactor * borrowIndexPrior) / 1e18 +

borrowIndexPrior;

// 9. 写⼊状态

accrualBlockNumber = currentBlockNumber;

borrowIndex = borrowIndexNew;

totalBorrows = totalBorrowsNew;

totalReserves = totalReservesNew;

emit AccrueInterest(

cashPrior,

interestAccumulated,

borrowIndexNew,

totalBorrowsNew

);

return uint(Error.NO_ERROR);

}区块利息 vs 时间利息:

5. Compound V3 (Comet) - 新⼀代架构

5.1 为什么需要V3?

Compound V2虽然成功,但也暴露了⼀些问题:

- 资本效率低:每个资产独⽴的资⾦池导致流动性分散

- Gas成本⾼:复杂的跨市场计算消耗⼤量Gas

- ⻛险管理复杂:多抵押品组合增加了⻛险评估难度

- ⽤户体验差:借多种资产需要多次操作

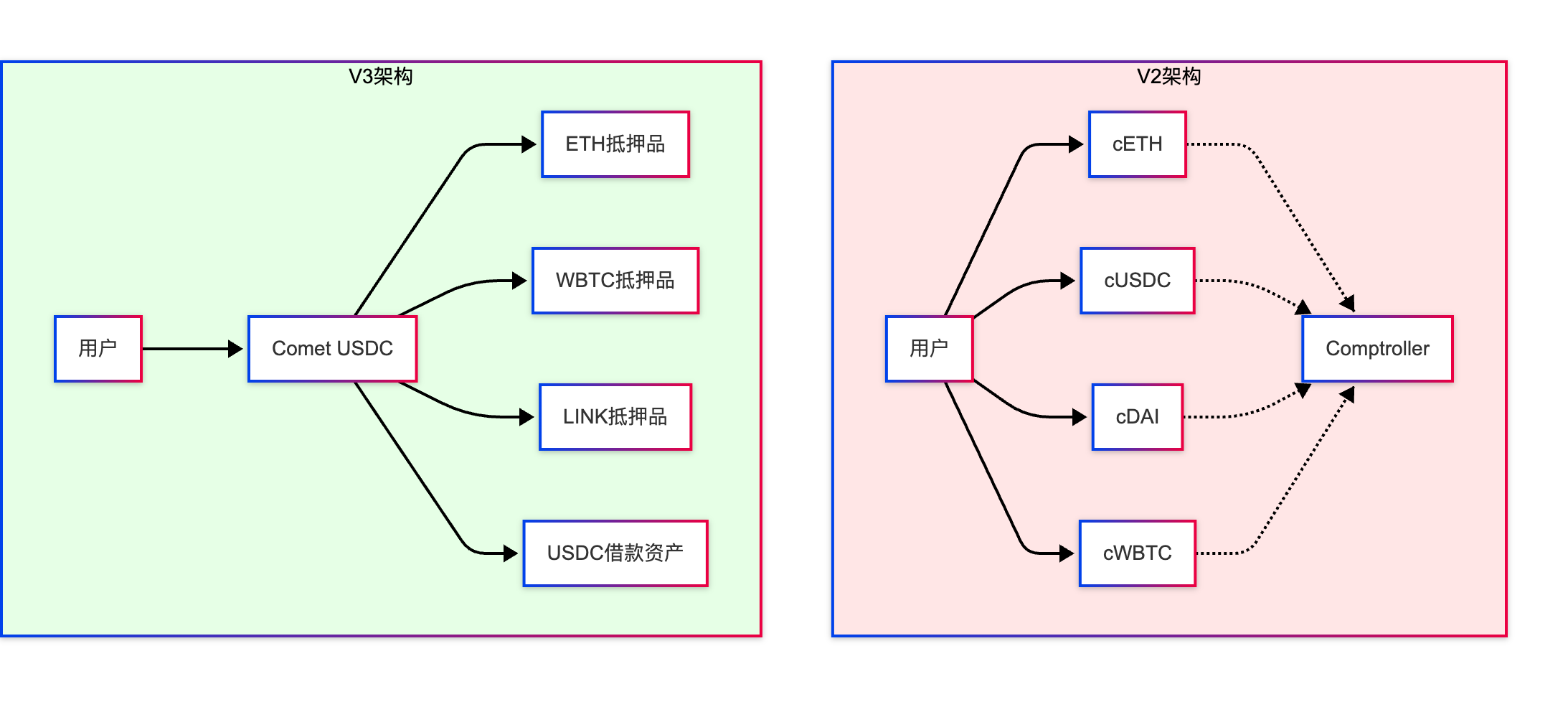

5.2 Comet核⼼设计

Compound V3(代号Comet)采⽤了全新的架构设计:

核⼼改变:

- 单⼀借款资产:每个Comet市场只⽀持借⼀种资产(如USDC)

- 多种抵押品:但可以接受多种资产作为抵押

- 原⽣收益:借款资产⾃动赚取收益(如USDC存⼊Compound Treasury)

- 简化逻辑:⼤幅降低合约复杂度和Gas成本

5.2.1 V2 vs V3 架构对⽐

V2 vs V3 功能对⽐:

5.2.2 Comet核⼼合约

c

// Comet.sol - Compound V3核⼼合约

pragma solidity 0.8.15;

contract Comet {

// 基础资产(唯⼀可借资产)

address public immutable baseToken;

// 抵押品配置

struct AssetConfig {

address asset;

uint8 decimals;

uint64 borrowCollateralFactor; // 借款抵押因⼦

uint64 liquidateCollateralFactor; // 清算抵押因⼦

uint128 supplyCap; // 供应上限

}

AssetConfig[] public assetConfigs;

// ⽤户基础资产余额(可正可负)

mapping(address => int256) public baseBalances;

// ⽤户抵押品余额

mapping(address => mapping(address => uint256)) public collateralBalances;

// 利率模型

uint64 public baseIndexScale = 1e15;

/**

* @notice 供应基础资产(类似V2的mint)

* @param amount 供应数量

*/

function supply(address asset, uint amount) external {

if (asset == baseToken) {

supplyBase(msg.sender, amount);

} else {

supplyCollateral(msg.sender, asset, amount);

}

}

/**

* @notice 供应基础资产

*/

function supplyBase(address from, uint amount) internal {

// 转⼊资产

doTransferIn(baseToken, from, amount);

// 增加⽤户余额(可能从负变正)

baseBalances[from] += int256(amount);

emit Supply(from, baseToken, amount);

}

/**

* @notice 供应抵押品

*/

function supplyCollateral(address from, address asset, uint amount) internal {

// 检查是否是⽀持的抵押品

AssetConfig memory config = getAssetConfig(asset);

require(config.asset != address(0), "Unsupported asset");

// 转⼊抵押品

doTransferIn(asset, from, amount);

// 增加抵押品余额

collateralBalances[from][asset] += amount;

emit SupplyCollateral(from, asset, amount);

}

/**

* @notice 取出资产

* @param asset 资产地址

* @param amount 取出数量

*/

function withdraw(address asset, uint amount) external {

if (asset == baseToken) {

withdrawBase(msg.sender, amount);

} else {

withdrawCollateral(msg.sender, asset, amount);

}

}

/**

* @notice 取出基础资产

*/

function withdrawBase(address to, uint amount) internal {

// 减少⽤户余额(可能从正变负,即借款)

baseBalances[to] -= int256(amount);

// 检查是否有⾜够的借款能⼒

if (baseBalances[to] < 0) {

require(isBorrowCollateralized(to), "Undercollateralized");

}

// 转出资产

doTransferOut(baseToken, to, amount);

emit Withdraw(to, baseToken, amount);

}

/**

* @notice 检查借款是否有⾜够抵押

*/

function isBorrowCollateralized(address account) public view returns (bool) {

int256 baseBalance = baseBalances[account];

// 如果余额为正,说明是供应者,不需要抵押

if (baseBalance >= 0) {

return true;

}

// 计算借款价值

uint256 borrowValue = presentValue(uint256(-baseBalance));

// 计算抵押品总价值

uint256 collateralValue = 0;

for (uint i = 0; i < assetConfigs.length; i++) {

AssetConfig memory config = assetConfigs[i];

uint256 collateralBalance = collateralBalances[account][config.asset];

if (collateralBalance > 0) {

// 获取抵押品价格

uint256 price = getPrice(config.asset);

// 计算加权价值

uint256 value = (collateralBalance * price) / (10 ** config.decimals);

collateralValue += (value * config.borrowCollateralFactor) / 1e18;

}

}

// 抵押品价值必须⼤于借款价值

return collateralValue >= borrowValue;

}

/**

* @notice 清算函数

* @param borrower 借款⼈

* @param asset 抵押品资产

* @param baseAmount 偿还的基础资产数量

*/

function absorb(address borrower, address[] calldata assets) external {

// 检查是否可以清算

require(!isBorrowCollateralized(borrower), "Not liquidatable");

// 计算借款⼈的债务

uint256 debt = uint256(-baseBalances[borrower]);

// 吸收所有抵押品

for (uint i = 0; i < assets.length; i++) {

address asset = assets[i];

uint256 collateralBalance = collateralBalances[borrower][asset];

if (collateralBalance > 0) {

// 将抵押品转移到协议储备

collateralBalances[borrower][asset] = 0;

collateralBalances[address(this)][asset] += collateralBalance;

emit AbsorbCollateral(borrower, asset, collateralBalance);

}

}

// 清除借款⼈的债务

baseBalances[borrower] = 0;

emit Absorb(borrower, debt);

}

}5.3 Comet的优势

- 更⾼的资本效率

V3中,所有抵押品共享同⼀个借款池,提⾼了资本利⽤率:

V2模式:

⽤户A: 在ETH市场存⼊,只能赚取ETH市场的利息

⽤户B: 在USDC市场存⼊,只能赚取USDC市场的利息

流动性分散

V3模式:所有USDC需求者共享同⼀个USDC池

⽆论抵押ETH、WBTC还是LINK,都从同⼀池⼦借USDC

流动性集中,效率更⾼

- 降低Gas成本

操作对⽐(以太坊主⽹):

存款:

V2: ~120,000 Gas

V3: ~75,000 Gas

节省: 37.5%

借款:V2: ~280,000 Gas

V3: ~160,000 Gas

节省: 42.9%

还款:V2: ~180,000 Gas

V3: ~110,000 Gas

节省: 38.9%

- 原⽣收益功能

V3将基础资产(如USDC)投资到其他收益协议,为⽤户创造额外收益:

USDC Comet市场:

- 闲置USDC⾃动存⼊Compound Treasury

- 赚取国债收益率(~4-5% APY)

- ⽤户获得:借款利息 + 国债收益

- 提⾼整体APY约1-2个百分点