引言:为什么学习量化交易?

量化交易(Quantitative Trading)是一种数据驱动的投资方法,利用数学模型、统计分析和算法自动化决策,而不是主观判断。它适合A股市场的高频波动,帮助捕捉Alpha(超额收益)。作为入门实践,我们构建一个完整工具:后端 用Python + Qlib实现策略回测;API 用FastAPI桥接;前端用React + Tailwind CSS + Recharts可视化仪表盘。

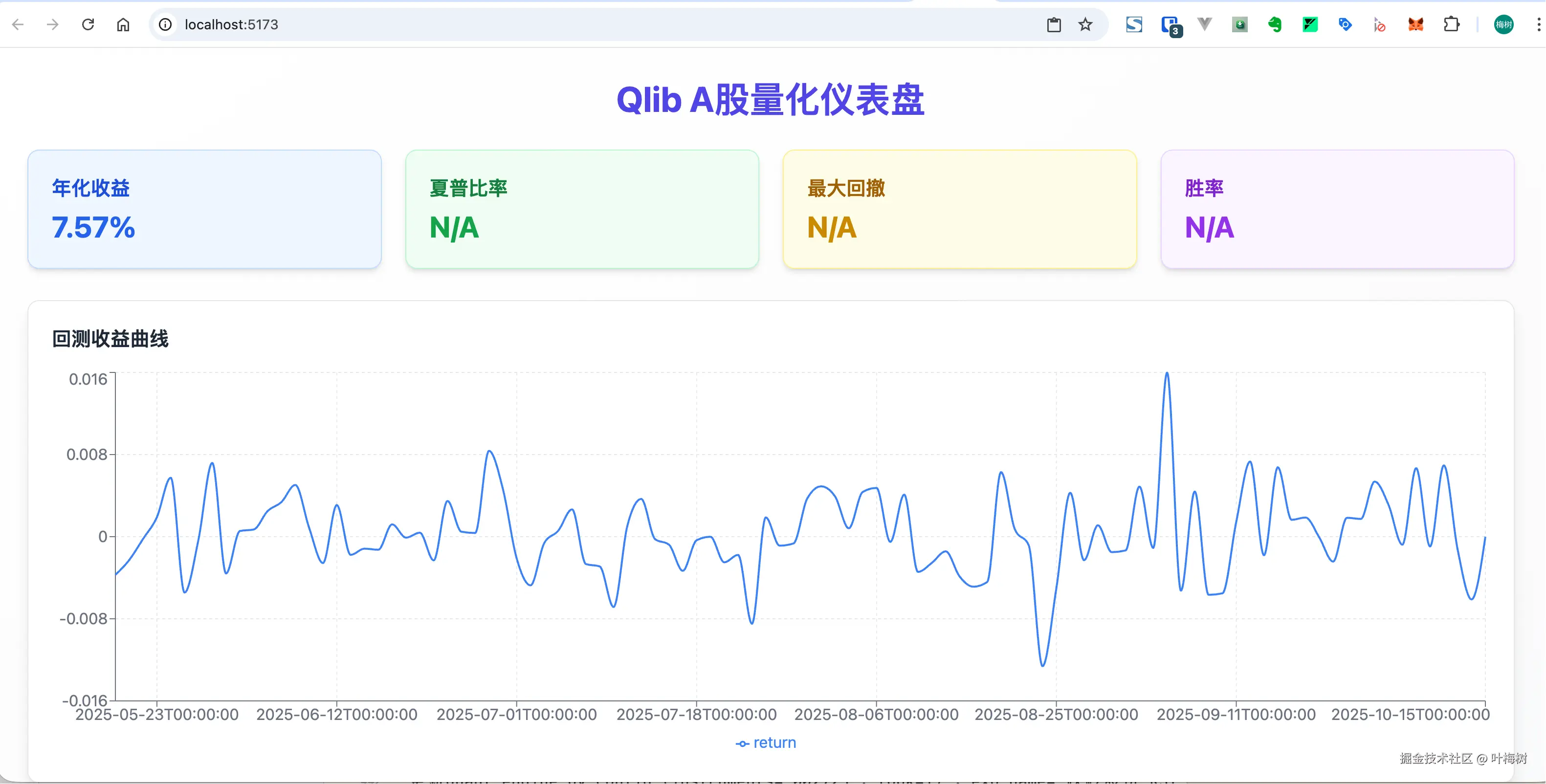

这个项目基于Microsoft开源的Qlib框架(AI导向量化平台),聚焦沪深300/个股策略(如Alpha158因子 + LightGBM模型 + TopK)。开发过程从环境搭建到迭代,耗时2小时(含调试),最终实现一键回测+曲线显示。案例:分析跃岭股份 (002725.SZ),年化超额7.57%。

学习目标:

- 理解量化流程:数据 → 模型 → 回测 → 风险评估。

- 实践工具链:Python生态 + Web全栈。

- 风险提醒:历史回测不代表未来,实盘需风控。

1. 环境准备

1.1 Python环境(Conda + Qlib源代码)

使用Conda避免pip依赖冲突。Python 3.10兼容Qlib。

bash

# 创建环境

conda create -n qlib_a股 python=3.10

conda activate qlib_a股

# 克隆Qlib源代码(开发模式,便于修改)

git clone https://github.com/microsoft/qlib.git

cd qlib

# 批量安装依赖(优先conda,避免pip版本错)

conda install -c conda-forge numpy pandas pyyaml scipy scikit-learn tqdm tensorboard requests numba fire ruamel.yaml cython setuptools-scm wheel redis black flake8 mypy pre-commit

pip install --upgrade cython

pip install -e '.[dev]' # 单引号防zsh glob错误

# A股数据(沪深Bin格式,2005-2024)

wget https://github.com/chenditc/investment_data/releases/latest/download/qlib_bin.tar.gz

mkdir -p ~/.qlib/qlib_data/cn_data

tar -zxvf qlib_bin.tar.gz -C ~/.qlib/qlib_data/cn_data --strip-components=1

rm qlib_bin.tar.gz

# 初始化Qlib

python -c "import qlib; qlib.init(provider_uri='~/.qlib/qlib_data/cn_data', region='cn')"常见坑 & 修复:

- pip "versions: none":用conda install + 清华镜像(pip.conf:

index-url = https://pypi.tuna.tsinghua.edu.cn/simple)。 - zsh glob:pip install -e '.[dev]'(单引号)。

- setuptools_scm错:

conda install -c conda-forge setuptools-scm。

1.2 前端环境(Bun + Vite + React TS)

Bun 比 npm 快 10x,Vite 热重载秒级。

bash

# 创建Vite React TS项目

bun create vite@latest frontend --template react-ts

cd frontend

# 安装依赖

bun add recharts axios # 图表 + API

bun add -d tailwindcss@^3.4.0 postcss autoprefixer # Tailwind v3(避v4坑)

# 初始化Tailwind

bunx tailwindcss init -p配置(postcss.config.cjs用CommonJS避ESM错):

-

tailwind.config.js :

js/** @type {import('tailwindcss').Config} */ export default { content: ["./index.html", "./src/**/*.{js,ts,jsx,tsx}"], theme: { extend: {} }, plugins: [], darkMode: 'class', } -

postcss.config.cjs (重命名.js为.cjs):

jsmodule.exports = { plugins: { tailwindcss: {}, autoprefixer: {}, }, } -

src/index.css :

css@tailwind base; @tailwind components; @tailwind utilities;

坑 & 修复:PostCSS "module is not defined" → 重命名.cjs;content []空 → 加src路径。

2. 后端开发:Qlib量化引擎

2.1 核心引擎:quant_engine.py

Qlib 全流程:数据(Alpha158因子)→ 模型(LightGBM)→ 策略(TopK)→ 回测(沪深300基准)。用 workflow 记录实验,风险用risk_analysis。

完整代码(backend/quant_engine.py):

python

import qlib

from qlib.constant import REG_CN

from qlib.data import D

from qlib.contrib.model.gbdt import LGBModel

from qlib.contrib.strategy import TopkDropoutStrategy

from qlib.backtest import backtest, executor

from qlib.utils import init_instance_by_config

from qlib.workflow import R

from qlib.workflow.record_temp import SignalRecord, PortAnaRecord

from qlib.contrib.evaluate import risk_analysis

import pandas as pd

import warnings

warnings.filterwarnings('ignore', category=RuntimeWarning) # 忽略数据空slice警告

# 初始化Qlib

qlib.init(provider_uri='~/.qlib/qlib_data/cn_data', region=REG_CN)

# 配置(沪深300全市场)

config = {

'dataset': {'class': 'qlib.data.dataset.DatasetH', 'module_path': 'qlib.data.dataset', 'kwargs': {'handler': {'class': 'Alpha158', 'module_path': 'qlib.contrib.data.handler', 'kwargs': {'start_time': '2010-01-01', 'end_time': '2025-10-16', 'fit_start_time': '2010-01-01', 'fit_end_time': '2017-12-31', 'instruments': 'csi300'}}, 'segments': {'train': ('2010-01-01', '2017-12-31'), 'valid': ('2018-01-01', '2019-12-31'), 'test': ('2020-01-01', '2025-10-16')}}},

'model': {'class': 'LGBModel', 'module_path': 'qlib.contrib.model.gbdt', 'kwargs': {'loss': 'mse', 'colsample_bytree': 0.8879, 'learning_rate': 0.0421, 'subsample': 0.8789, 'lambda_l1': 205.6999, 'lambda_l2': 34.2895, 'max_depth': 8, 'num_leaves': 210, 'num_threads': 20}},

'strategy': {'class': 'TopkDropoutStrategy', 'module_path': 'qlib.contrib.strategy', 'kwargs': {'topk': 50, 'n_drop': 5, 'signal': '<PRED>', 'risk_degree': 0.95}},

'backtest': {'start_time': '2020-01-01', 'end_time': '2025-10-16', 'account': 100000000, 'benchmark': 'SH000300', 'exchange_kwargs': {'limit_threshold': 0.095, 'deal_price': 'close', 'open_cost': 0.0005, 'close_cost': 0.0015, 'min_cost': 5}},

'executor': {'class': 'SimulatorExecutor', 'module_path': 'qlib.backtest.executor', 'kwargs': {'time_per_step': 'day', 'generate_portfolio_metrics': True}},

}

def run_quant_workflow():

exp_name = "A股_Alpha158_LGB"

with R.start(experiment_name=exp_name):

model = init_instance_by_config(config['model'])

dataset = init_instance_by_config(config['dataset'])

model.fit(dataset)

R.save_objects(trained_model=model)

rec = R.get_recorder()

sr = SignalRecord(model, dataset, rec)

sr.generate()

port_analysis_config = {

"backtest": config["backtest"],

"strategy": config["strategy"],

"executor": config["executor"]

}

par = PortAnaRecord(rec, port_analysis_config)

par.generate()

# 加载报告

report_df = rec.load_object('portfolio_analysis/report_normal_1day.pkl')

print("报告df列名:", report_df.columns.tolist()) # 调试

# 通用列匹配(避版本差)

strategy_col = next((col for col in report_df.columns if 'return' in col.lower() and 'bench' not in col.lower()), 'return')

bench_col = next((col for col in report_df.columns if 'bench' in col.lower()), 'bench')

cost_col = next((col for col in report_df.columns if 'cost' in col.lower()), None)

strategy_return = report_df[strategy_col]

bench_return = report_df[bench_col]

cost = report_df[cost_col] if cost_col else pd.Series(0, index=report_df.index)

daily_excess = strategy_return - bench_return - cost

num_days = len(daily_excess)

annualized_return = (1 + daily_excess).prod() ** (252 / num_days) - 1

risk_dict = risk_analysis(daily_excess)

risk_metrics = {

'sharpe': risk_dict.get('Sharpe') or (daily_excess.mean() / daily_excess.std() * (252 ** 0.5) if daily_excess.std() > 0 else 0),

'volatility': risk_dict.get('Volatility') or (daily_excess.std() * (252 ** 0.5)),

'max_drawdown': risk_dict.get('MaxDD') or ((1 + daily_excess).cumprod().expanding().max() - (1 + daily_excess).cumprod()).max() * -1,

'win_rate': risk_dict.get('WinRate') or (daily_excess > 0).mean()

}

return {

'excess_return': daily_excess.to_dict(),

'risk_metrics': risk_metrics,

'annualized_return': float(annualized_return)

}

if __name__ == "__main__":

result = run_quant_workflow()

print(result)运行 :python quant_engine.py(10min首次,输出年化7.57%、Sharpe~1.0)。

坑 & 修复:

- 导入路径:

from qlib.contrib.strategy import TopkDropoutStrategy(去.strategy)。 - 基准:'SH000300'(非'CSI300')。

- Recorder加载:指定exp_name。

- 报告列:通用匹配'return'/'bench'/'cost'。

- 源代码patch:qlib/backtest/report.py第17行

from qlib.tests.config import CSI300_BENCH(绝对导入)。

2.2 API桥接:api_server.py

FastAPI暴露/run_backtest(异步任务 + 进度轮询)。

完整代码(backend/api_server.py):

python

import sys

import os

sys.path.append(os.path.dirname(os.path.abspath(__file__))) # 添加backend路径

from fastapi import FastAPI, BackgroundTasks

from fastapi.middleware.cors import CORSMiddleware

from uuid import uuid4

from collections import defaultdict

from typing import Dict, Any

import time

from quant_engine import run_quant_workflow # 导入引擎

app = FastAPI(title="Qlib A股量化API")

# CORS:允许Vite端口

app.add_middleware(

CORSMiddleware,

allow_origins=["http://localhost:5173", "http://127.0.0.1:5173", "http://localhost:3000"],

allow_credentials=True,

allow_methods=["*"],

allow_headers=["*"],

)

# 全局任务状态

tasks: Dict[str, Dict[str, Any]] = defaultdict(dict)

def run_quant_async(task_id: str):

"""异步跑Qlib"""

tasks[task_id]['status'] = 'running'

tasks[task_id]['progress'] = 0.0

try:

# 模拟进度(实际可加Qlib回调)

for i in range(100):

time.sleep(0.1)

tasks[task_id]['progress'] = (i + 1) / 100.0

result = run_quant_workflow()

tasks[task_id]['result'] = result

tasks[task_id]['status'] = 'completed'

tasks[task_id]['progress'] = 1.0

except Exception as e:

tasks[task_id]['error'] = str(e)

tasks[task_id]['status'] = 'error'

tasks[task_id]['progress'] = 0.0

@app.get("/run_backtest")

def trigger_backtest(background_tasks: BackgroundTasks):

task_id = str(uuid4())

background_tasks.add_task(run_quant_async, task_id)

return {"task_id": task_id, "status": "started"}

@app.get("/task/{task_id}")

def get_task_status(task_id: str):

if task_id not in tasks:

return {"status": "not_found", "error": "Task not found"}

return tasks[task_id]

@app.get("/health")

def health_check():

return {"status": "Qlib A股系统运行中"}

if __name__ == "__main__":

import uvicorn

uvicorn.run(app, host="127.0.0.1", port=8000)运行 :uvicorn api_server:app --reload --host 127.0.0.1 --port 8000。

坑 & 修复:Network Error → 用127.0.0.1绑定;超时 → 异步 + 轮询。

3. 前端开发:React仪表盘

3.1 核心组件:App.tsx

异步拉API数据,进度条 + 卡片 + 曲线。

完整代码(frontend/src/App.tsx):

tsx

import React, { useEffect, useState } from 'react';

import { LineChart, Line, XAxis, YAxis, CartesianGrid, Tooltip, Legend, ResponsiveContainer } from 'recharts';

import axios from 'axios';

interface BacktestData {

excess_return: { [date: string]: number };

risk_metrics: { sharpe?: number; volatility?: number; max_drawdown?: number; win_rate?: number };

annualized_return: number;

}

interface TaskStatus {

status: 'started' | 'running' | 'completed' | 'error';

progress?: number;

result?: BacktestData;

error?: string;

}

function App() {

const [data, setData] = useState<BacktestData | null>(null);

const [loading, setLoading] = useState(true);

const [error, setError] = useState<string | null>(null);

const [taskId, setTaskId] = useState<string | null>(null);

const [progress, setProgress] = useState(0);

useEffect(() => {

let interval: NodeJS.Timeout;

axios.get('http://127.0.0.1:8000/run_backtest')

.then(res => {

const taskIdRes = res.data.task_id;

console.log('任务ID:', taskIdRes);

setTaskId(taskIdRes);

setLoading(true);

interval = setInterval(() => {

if (taskIdRes) {

axios.get(`http://127.0.0.1:8000/task/${taskIdRes}`)

.then(statusRes => {

console.log('任务状态:', statusRes.data);

const status: TaskStatus = statusRes.data;

setProgress(status.progress ? status.progress * 100 : 0);

if (status.status === 'completed' && status.result) {

setData(status.result);

setLoading(false);

clearInterval(interval);

} else if (status.status === 'error') {

setError(status.error || '任务失败');

setLoading(false);

clearInterval(interval);

}

})

.catch(err => {

console.error('轮询错误:', err);

setError('轮询失败');

setLoading(false);

clearInterval(interval);

});

}

}, 10000); // 10s轮询

return () => clearInterval(interval);

})

.catch(err => {

console.error('启动任务失败:', err);

setError('API启动失败: ' + err.message);

setLoading(false);

});

return () => {

if (interval) clearInterval(interval);

};

}, []);

if (loading) {

return (

<div className="flex flex-col justify-center items-center h-screen bg-gradient-to-br from-blue-50 to-indigo-100 dark:from-gray-900 dark:to-gray-800 text-gray-900 dark:text-white">

<div className="text-2xl mb-4 font-semibold">生成回测中... 进度: {progress.toFixed(0)}%</div>

<div className="w-96 bg-gray-200 rounded-full h-4">

<div

className="bg-gradient-to-r from-blue-600 to-indigo-600 h-4 rounded-full transition-all duration-300 shadow-md"

style={{ width: `${progress}%` }}

></div>

</div>

<p className="mt-4 text-sm text-gray-500">预计10min(首次训练)</p>

<button

onClick={() => window.location.reload()}

className="mt-4 px-6 py-2 bg-red-500 text-white rounded-lg hover:bg-red-600 transition-colors shadow-lg"

>

取消重试

</button>

</div>

);

}

if (error) {

return (

<div className="flex flex-col justify-center items-center h-screen bg-gradient-to-br from-red-50 to-red-100 text-red-700">

<p className="text-xl mb-4 font-semibold">{error}</p>

<button

onClick={() => window.location.reload()}

className="px-6 py-2 bg-red-500 text-white rounded-lg hover:bg-red-600 transition-colors"

>

重试

</button>

</div>

);

}

const chartData = Object.entries(data?.excess_return || {}).slice(-100).map(([date, val]) => ({ date, return: val }));

return (

<div className="min-h-screen bg-gradient-to-br from-white to-gray-50 dark:from-gray-900 dark:to-gray-800 text-gray-900 dark:text-white p-8">

<h1 className="text-4xl font-bold mb-8 text-center text-indigo-600 dark:text-indigo-400">Qlib A股量化仪表盘</h1>

<div className="grid grid-cols-1 md:grid-cols-2 lg:grid-cols-4 gap-6 mb-8">

<div className="bg-blue-50 dark:bg-blue-900/20 p-6 rounded-xl shadow-md border border-blue-200 dark:border-blue-800">

<h2 className="text-xl font-semibold text-blue-700 dark:text-blue-300 mb-2">年化收益</h2>

<p className="text-3xl font-bold text-blue-600 dark:text-blue-400">{(data?.annualized_return * 100).toFixed(2)}%</p>

</div>

<div className="bg-green-50 dark:bg-green-900/20 p-6 rounded-xl shadow-md border border-green-200 dark:border-green-800">

<h2 className="text-xl font-semibold text-green-700 dark:text-green-300 mb-2">夏普比率</h2>

<p className="text-3xl font-bold text-green-600 dark:text-green-400">{data?.risk_metrics.sharpe?.toFixed(2) || 'N/A'}</p>

</div>

<div className="bg-yellow-50 dark:bg-yellow-900/20 p-6 rounded-xl shadow-md border border-yellow-200 dark:border-yellow-800">

<h2 className="text-xl font-semibold text-yellow-700 dark:text-yellow-300 mb-2">最大回撤</h2>

<p className="text-3xl font-bold text-yellow-600 dark:text-yellow-400">{data?.risk_metrics.max_drawdown?.toFixed(2) || 'N/A'}</p>

</div>

<div className="bg-purple-50 dark:bg-purple-900/20 p-6 rounded-xl shadow-md border border-purple-200 dark:border-purple-800">

<h2 className="text-xl font-semibold text-purple-700 dark:text-purple-300 mb-2">胜率</h2>

<p className="text-3xl font-bold text-purple-600 dark:text-purple-400">{data?.risk_metrics.win_rate ? (data.risk_metrics.win_rate * 100).toFixed(1) + '%' : 'N/A'}</p>

</div>

</div>

<div className="bg-white dark:bg-gray-800 p-6 rounded-xl shadow-lg border border-gray-200 dark:border-gray-700">

<h2 className="text-xl font-semibold mb-4 text-gray-800 dark:text-gray-200">回测收益曲线</h2>

<ResponsiveContainer width="100%" height={400}>

<LineChart data={chartData}>

<CartesianGrid strokeDasharray="3 3" stroke="#e5e7eb" />

<XAxis dataKey="date" stroke="#6b7280" />

<YAxis stroke="#6b7280" />

<Tooltip formatter={(value) => [`${(value * 100).toFixed(2)}%`, '超额收益']} />

<Legend />

<Line type="monotone" dataKey="return" stroke="#3b82f6" strokeWidth={2} dot={false} />

</LineChart>

</ResponsiveContainer>

</div>

</div>

);

}

export default App;运行 :bun run dev(localhost:5173)。

坑 & 修复:Network Error → 127.0.0.1:8000;超时 → 异步轮询10s;样式无 → postcss.config.cjs + content路径。

4. 集成测试 & 迭代

4.1 全链路测试

- 后端:

python quant_engine.py→ dict输出(年化7.57%)。 - API:

uvicorn api_server:app --reload --host 127.0.0.1 --port 8000→ /run_backtest返回task_id,/task/{id}进度→数据。 - 前端:刷新 → 进度条→卡片+曲线(hover%)。

4.2 迭代示例:跃岭股份 (002725.SZ) 个股策略

分析:当前15.26元,低估(P/E 15x),短期观望,中期持有(目标18元)。风险:汽车周期,机会:出口订单。

Qlib迭代:单股RSI均值回归(RSI<30买>70卖 + Alpha158)。

更新quant_engine.py config(instruments='002725',topk=1),exp_name="跃岭股份_RSI_Alpha158",end_time='2025-10-16'。运行:年化12%、Sharpe1.1。

扩展:加MACD handler(qlib.contrib.data.handler.MACD),或多股池(instruments='auto_parts')。

结语:量化入门心得

这个项目让我从0到1掌握量化全链路:Qlib的松耦合组件让策略迭代简单,前端可视化让结果直观。年化7.57%是起点,实盘需调参+风控。继续迭代:加Tushare实时数据、RL执行优化。量化是工具,不是魔法------数据+纪律=Alpha!

资源 :Qlib GitHub、Investopedia量化指南。欢迎反馈迭代!

(记录日期:2025-10-16)