业务痛点:某城商行个人贷款年放款额超500亿元,人工审核依赖经验判断,存在三大问题:

- 效率低:单笔审核耗时2-3天,旺季积压严重

- 主观性强:不同审核员对"收入稳定性"等指标判断差异大,导致风险偏好不一致

- 漏判率高:历史数据显示,人工审核后首年违约率仍达3.2%,年损失超5000万元

项目目标:构建逻辑回归违约风险预测模型,实现"申请信息→违约概率"的自动化评估,目标:

- 模型性能:AUC-ROC≥0.85,KS值≥0.4(区分违约/正常客户)

- 业务效率:审核时间从3天缩短至2小时,人工干预率降低50%

- 风险控制:首年违约率降至2.8%以下,年减少损失≥3000万元

开发环境与工具链

- 语言:Python 3.9

- 数据处理:Pandas 1.5+、NumPy 1.23+、Imbalanced-learn(SMOTE)

- 模型训练:Scikit-learn 1.2+(逻辑回归)、SHAP(特征重要性解释)

- 实验跟踪:MLflow(记录参数/指标/模型)

- 服务部署:Flask 2.3+、Gunicorn(WSGI服务器)、Docker 24.0+

- 版本控制:Git + DVC(数据版本管理)

- 监控:Prometheus(指标采集)+ Grafana(可视化)

数据准备与特征变化

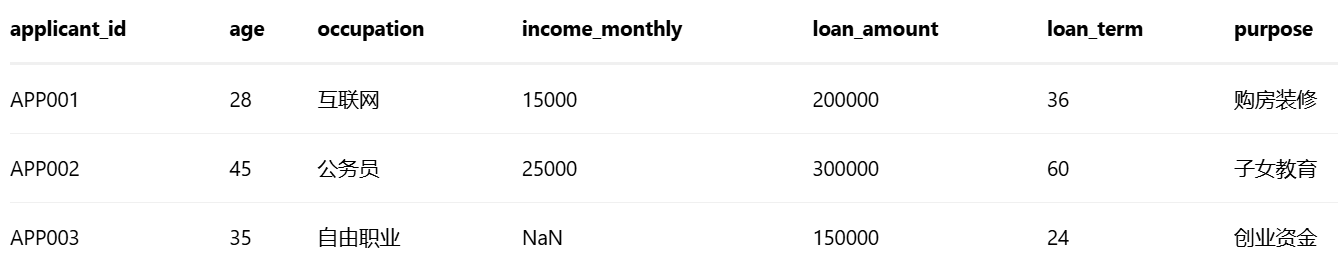

(1)原数据结构(示例)

① 信贷申请表(loan_applications.csv)

② 央行征信数据(credit_records.csv)

③ 历史贷款数据库(historical_loans.csv,含标签)

④ 第三方数据(社保/公积金,social_security.csv)

(2)数据清洗与特征工程

缺失值:

- income_monthly(月收入):自由职业者用"社保缴纳基数×行业均值"填充(如互联网行业均值1.2倍)

- overdue_times_1y(1年内逾期次数):无征信记录者填0(视为信用白户)

异常值处理:

- ebt_ratio(负债比)>1(资不抵债)视为无效,用同类职业中位数替换

- age<22或>65(超出常规工作年龄):标记为高风险,单独分组

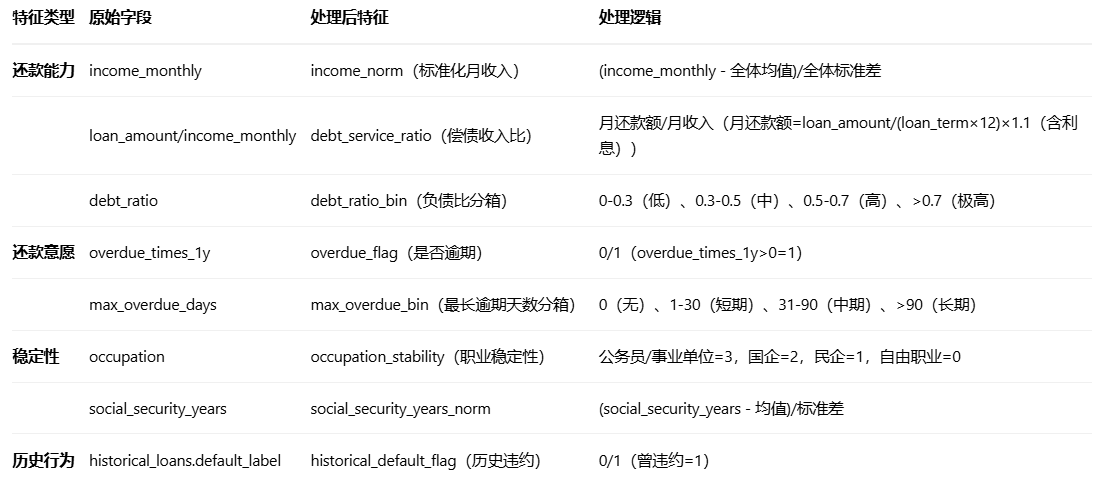

特征提取:

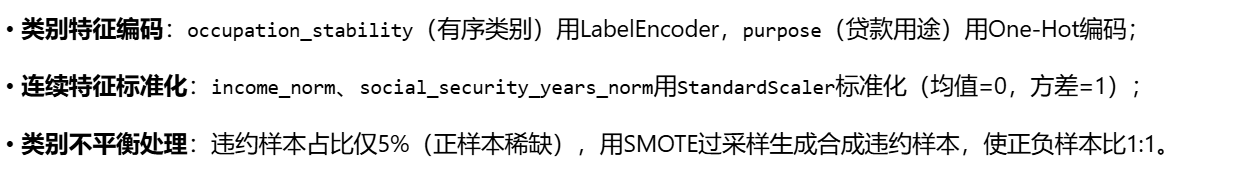

特征编码与标准化

- 互联网、公务员、自由职业类别用LabelEncoder

- 购房装修、子女教育、创业资金用One-Hot

- 收入、社保年限用StandardScaler标准化

- SMOTE过采用合成

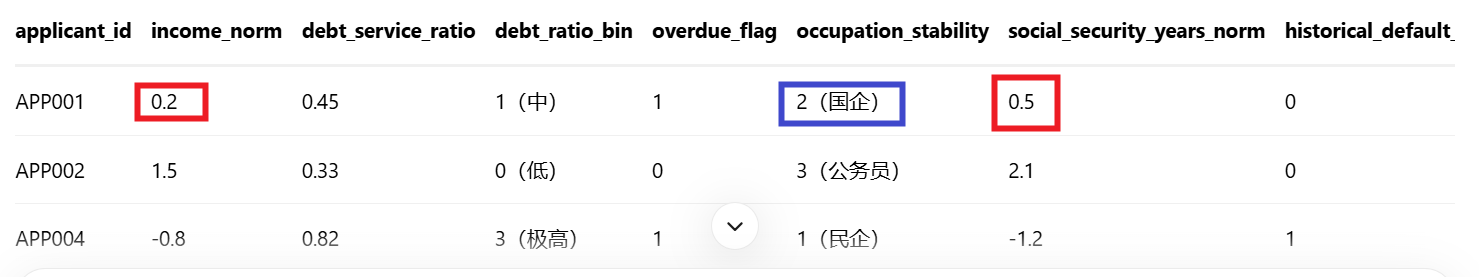

处理后的数据(特征矩阵)

代码结构

text

credit_risk_prediction/ # 项目根目录

├── data/ # 数据存储

│ ├── raw/ # 原始数据(DVC跟踪)

│ │ ├── loan_applications.csv

│ │ ├── credit_records.csv

│ │ ├── historical_loans.csv

│ │ └── social_security.csv

│ ├── processed/ # 处理后数据

│ │ └── features_train.parquet

│ └── external/ # 外部数据(职业稳定性映射表)

│ └── occupation_stability_map.json

├── src/ # 源代码

│ ├── data_processing/ # 数据处理模块

│ │ ├── __init__.py

│ │ ├── clean_data.py # 数据清洗

│ │ └── feature_engineering.py # 特征工程

│ ├── model/ # 模型模块

│ │ ├── __init__.py

│ │ ├── train.py # 模型训练(逻辑回归)

│ │ ├── evaluate.py # 模型评估(AUC/KS)

│ │ ├── explain.py # 特征重要性解释(SHAP)

│ │ └── predict.py # 预测推理

│ ├── api/ # API服务

│ │ ├── app.py # Flask服务入口

│ │ └── schemas.py # 请求/响应格式定义(Pydantic)

│ └── utils/ # 工具函数

│ ├── logger.py # 日志配置

│ ├── config.py # 配置文件(路径/参数)

│ └── metrics.py # 自定义评估指标(KS值)

├── tests/ # 单元测试

│ ├── test_feature_engineering.py

│ └── test_model.py

├── docker/ # Docker部署文件

│ ├── Dockerfile

│ └── requirements.txt

├── mlruns/ # MLflow实验跟踪(Git忽略)

├── README.md # 项目说明

└── requirements.txt # Python依赖数据清洗与特征工程(src/data_processing/feature_engineering.py)

还款能力:业务意义,衡量借款人的还款压力,比率越高风险越大

- loan_amount / (loan_term * 12):计算基础月还款额(本金)

-

- 1.1:增加10%作为利息估算

- / income_monthly:得到债务收入比

还款意愿特征:

- debt_ratio 分箱:0-30%(0),30-50%(1),50-70%(2),70-100%(3)

- max_overdue_days 分箱:无逾期(0),1-30天(1),31-90天(2),90天以上(3)

稳定性特征:

- 将职业类型映射为稳定性分数(occ_map 是预设的映射字典)

- 未映射的职业默认值为0(最不稳定)

数据合并:

text

apps_df(申请信息)

↓ 合并 ss_df(可能为社保/工作信息)

↓ 合并 credit_df(信用信息)

↓ 合并 hist_df(历史表现,包含标签)

python

import pandas as pd

import numpy as np

import json

from sklearn.preprocessing import StandardScaler,LabelEncoder,OneHotEncoder

from imblearn.voer_sampling import SMOTE # 处理类别不平衡

from src.utils.logger import get_logger

logger = get_logger(__name__)

def load_occupation_stability_map(path:str)->dict:

"""加载职业稳定性映射表(外部配置)"""

with open(path,"r") as f:

return json.load(f)

def feature_engineering(raw_data_dir:str,external_dir:str,output_path:str):

"""

特征工程主函数:整合原始数据→清洗→特征提取→编码→标准化→过采样→保存

Args:

raw_data_dir: 原始数据目录(含4个CSV)

external_dir: 外部数据目录(职业稳定性映射表)

output_path: 处理后特征矩阵保存路径(parquet)

Returns:

processed_df: 处理后的特征矩阵(含标签)

scaler: 标准化器(用于预测时复用)

smote: SMOTE过采样对象(记录采样参数)

"""

# 1.加载原始数据

apps_df = pd.read_csv(f"{raw_data_dir}/loan_applications.csv")

credit_df = pd.read_csv(f"{raw_data_dir}/credit_records.csv")

hist_df = pd.read_csv(f"{raw_data_dir}/historical_loans.csv")

ss_df = pd.read_csv(f"{raw_data_dir}/social_security.csv")

occ_map = load_occupation_stability_map(f"{external_dir}/occupation_stability_map.json")# 职业稳定性映射

# 2.数据清洗

# 填充月收入缺失值(自由职业者用社保技术*1.2)

apps_df["income_monthly"] = apps_df.apply(

lambda x: x["income_monthly"] if not pd.isna(x["income_monthly"])

else ss_df[ss_df["applicant_id"] == x["applicant_id"]]["social_security_base"].iloc[0] * 1.2

if x["occupation"] == "自由职业" and not ss_df[ss_df["applicant_id"] == x["applicant_id"]].empty

else apps_df["income_monthly"].median(), # 其他情况用中位数

axis=1

)

# 2.2 处理负债比异常值(>1视为无效,用同类职业中位数替换)

occ_median_debt = credit_df.groupby("applicant_id").apply( # 按申请人关联职业后计算

lambda x: apps_df[apps_df["applicant_id"] == x.name]["occupation"].iloc[0]

).reset_index().merge(apps_df[["applicant_id", "occupation"]], on="applicant_id").groupby("occupation")["debt_ratio"].median()

credit_df["debt_ratio"] = credit_df.apply(

lambda x: occ_median_debt[apps_df[apps_df["applicant_id"] == x["applicant_id"]]["occupation"].iloc[0]]

if x["debt_ratio"] > 1 else x["debt_ratio"], axis=1

)

# 3.特征提取(核心业务逻辑)

# 3.1 还款能力特征

apps_df["debt_service_ratio"] = (apps_df["loan_amount"] / (apps_df["loan_term"] * 12)) * 1.1 / apps_df["income_monthly"] # 含利息月还款额/月收入

# 将连续变量debt_ratio(负债比)进行分箱处理

credit_df["debt_ratio_bin"] = pd.cut(credit_df["debt_ratio"], bins=[0, 0.3, 0.5, 0.7, 1], labels=[0, 1, 2, 3]) # 负债比分箱

# 3.2 还款意愿特征

credit_df["overdue_flag"] = (credit_df["overdue_times_1y"] > 0).astype(int)

credit_df["max_overdue_bin"] = pd.cut(credit_df["max_overdue_days"], bins=[-1, 0, 30, 90, np.inf], labels=[0, 1, 2, 3])

# 3.3 稳定性特征

apps_df["occupation_stability"] = apps_df["occupation"].map(occ_map).fillna(0) # 映射职业稳定性(默认0)

merged_df = apps_df.merge(ss_df, on="applicant_id", how="left").merge(credit_df, on="applicant_id", how="left").merge(hist_df[["applicant_id", "default_label"]], on="applicant_id", how="left")

# 4. 特征编码与标准化

# 4.1 类别特征编码

# 有序类别:occupation_stability(LabelEncoder)

le = LabelEncoder()

merged_df["occupation_stability_enc"] = le.fit_transform(merged_df["occupation_stability"])

# 无序类别:purpose(One-Hot编码)

ohe = OneHotEncoder(sparse_output=False,drop="first") # 避免多重共线性

purpose_ohe = ohe.fit_transform(merged_df[["purpose"]])

purpose_cols = [f"purpose_{cat}" for cat in ohe.categories_[0][1:]] # 去掉第一个类别

purpose_df = pd.DataFrame(purpose_ohe, columns=purpose_cols)

# 4.2 连续特征标准化

continuous_features = ["income_monthly", "social_security_years"]

scaler = StandardScaler()

merged_df[continuous_features] = scaler.fit_transform(merged_df[continuous_features])

merged_df.rename(columns={"income_monthly": "income_norm", "social_security_years": "social_security_years_norm"}, inplace=True)

# 5. 类别不平衡处理(SMOTE过采样)

features = [

"income_norm", "debt_service_ratio", "debt_ratio_bin", "overdue_flag",

"occupation_stability_enc", "social_security_years_norm", "historical_default_flag"

] + purpose_cols

X = merged_df[features]

y = merged_df["default_label"] # 标签:1=违约,0=正常

smote = SMOTE(random_state=42, sampling_strategy=1.0) # 正负样本比1:1

X_resampled, y_resampled = smote.fit_resample(X, y)

# 6. 构造最终特征矩阵

processed_df = pd.concat([X_resampled.reset_index(drop=True), y_resampled.reset_index(drop=True)], axis=1)

processed_df.to_parquet(output_path, index=False)

logger.info(f"特征工程完成,保存至{output_path},样本数:{len(processed_df)}(原始{y.sum()}正样本,过采样后{y_resampled.sum()}正样本)")

return processed_df, scaler, smote

模型训练与评估(src/model/train.py& evaluate.py)

python

import pandas as pd

from sklearn.linear_model import LogisticRegression

from sklearn.model_selection import train_test_split

from src.utils.logger import get_logger

import mlflow

import joblib

logger = get_logger(__name__)

def train_logistic_regression(features_path: str, test_size: float = 0.2, random_state: int = 42, C: float = 1.0):

"""

训练逻辑回归模型(带L2正则化)

Args:

features_path: 特征矩阵路径(parquet)

test_size: 测试集比例

random_state: 随机种子

C: 正则化强度倒数(C越小正则化越强)

Returns:

model: 训练好的逻辑回归模型

X_test, y_test: 测试集特征与标签

scaler: 标准化器(从特征工程返回,此处简化为重新加载)

"""

# 加载特征矩阵

df = pd.read_parquet(features_path)

X = df.drop(columns=["default_label"])

y = df["default_label"]

# 划分训练集/测试集

X_train, X_test, y_train, y_test = train_test_split(

X, y, test_size=test_size, random_state=random_state, stratify=y # 分层抽样保持类别分布

)

# 训练逻辑回归模型(L2正则化,Sigmoid激活)

model = LogisticRegression(

penalty="12",# L2正则化

C=C,# 正则化强度倒数

solver="liblinear", # 适用于小数据集

class_weight="balanced", # 平衡类别权重(备选方案)

random_state=random_state

)

model.fit(X_train,y_train)

#记录实验(MLflow)

with mlflow.start_run():

mlflow.log_param("model", "LogisticRegression")

mlflow.log_param("penalty", "l2")

mlflow.log_param("C", C)

mlflow.log_metric("train_accuracy", model.score(X_train, y_train))

mlflow.log_metric("test_accuracy", model.score(X_test, y_test))

mlflow.sklearn.log_model(model, "logistic_regression_model")

logger.info(f"模型训练完成,参数C={C},测试集准确率={model.score(X_test, y_test):.4f}")

# 保存模型和标准化器

joblib.dump(model, "model/logistic_regression_model.pkl")

joblib.dump(scaler, "model/scaler.pkl") # 假设scaler已保存

return model, X_test, y_test

python

# src/model/evaluate.py

import numpy as np

import pandas as pd

from sklearn.metrics import roc_auc_score, confusion_matrix, classification_report

from src.utils.metrics import calculate_ks # 自定义KS值计算

from src.utils.logger import get_logger

logger = get_logger(__name__)

def evaluate_model(model, X_test, y_test):

"""

评估模型性能(AUC-ROC/KS/混淆矩阵)

Args:

model: 训练好的模型

X_test: 测试集特征

y_test: 测试集标签

Returns:

metrics: 评估指标字典

验收标准:测试集AUC-ROC≥0.85,KS≥0.4,精确率≥0.75,召回率≥0.60

"""

y_pred_proba = model.predict_proba(X_test)[:,1] # 违约概率(正类概率)

y_pred = model.predict(X_test) # 预测类别(阈值=0.5)

# 核心指标

auc = roc_auc_score(y_test,y_pred_proba)

ks = calculate_ks(y_test,y_pred_proba)

cm = confusion_matrix(y_test,y_pred)

tn,fp,fn,tp = cm.ravel()

precision = tp/(tp+fp)if(tp+fp)>0 else 0

recall = tp/(tp+fn) if (tp+fn)>0 else 0

metircs = {

"AUC-ROC": auc,

"KS": ks,

"Precision": precision,

"Recall": recall,

"ConfusionMatrix": {"TN": tn, "FP": fp, "FN": fn, "TP": tp}

}

logger.info(f"模型评估结果:{metrics}")

return metrics

# src/utils/metrics.py(KS值计算)

def calculate_ks(y_true, y_pred_proba):

"""计算KS值(区分违约/正常客户的能力)"""

df = pd.DataFrame({"y_true": y_true, "y_pred_proba": y_pred_proba}).sort_values("y_pred_proba", ascending=False)

df["cum_good"] = (1 - df["y_true"]).cumsum() / (1 - df["y_true"]).sum()

df["cum_bad"] = df["y_true"].cumsum() / df["y_true"].sum()

df["ks"] = df["cum_bad"] - df["cum_good"]

return df["ks"].max()模型服务化(Flask API,src/api/app.py)

python

from flask import Flask, request, jsonify

import joblib

import pandas as pd

import numpy as np

from src.data_processing.feature_engineering import feature_engineering # 复用特征工程逻辑(简化版)

from src.utils.logger import get_logger

from pydantic import BaseModel, Field # 请求参数校验

logger = get_logger(__name__)

app = Flask(__name__)

# 加载模型与服务端资源(启动时加载)

model = joblib.load("model/logistic_regression_model.pkl")

scaler = joblib.load("model/scaler.pkl")

occupation_stability_map = {"公务员": 3, "事业单位": 3, "国企": 2, "民企": 1, "自由职业": 0}

# 请求参数校验模型

class PredictionRequest(BaseModel):

applicant_id: str = Field(..., description="申请人ID")

age: int = Field(..., ge=22, le=65, description="年龄(22-65岁)")

occupation: str = Field(..., description="职业")

income_monthly: float = Field(..., gt=0, description="月收入(元)")

loan_amount: float = Field(..., gt=0, description="贷款金额(元)")

loan_term: int = Field(..., ge=12, le=60, description="贷款期限(月,12-60)")

purpose: str = Field(..., description="贷款用途")

overdue_times_1y: int = Field(default=0, ge=0, description="1年内逾期次数")

debt_ratio: float = Field(default=0.0, ge=0, lt=1, description="负债比")

social_security_years: float = Field(default=0.0, ge=0, description="社保缴纳年限")

historical_default_flag: int = Field(default=0, ge=0, le=1, description="历史违约标志(0/1)")

@app.route("/predict_risk", methods=["POST"])

def predict_rick():

"""

违约风险预测API

请求格式:JSON(符合PredictionRequest模型)

响应格式:JSON(违约概率、风险等级、关键影响因素)

"""

try:

# 1.参数校验与解析

req_data = request.get_json()

req = PredictionRequest(**req_data)

# 2. 构造单条样本(复用特征工程逻辑)

sample = {

"applicant_id": req.applicant_id,

"age": req.age,

"occupation": req.occupation,

"income_monthly": req.income_monthly,

"loan_amount": req.loan_amount,

"loan_term": req.loan_term,

"purpose": req.purpose,

"overdue_times_1y": req.overdue_times_1y,

"debt_ratio": req.debt_ratio,

"social_security_years": req.social_security_years,

"historical_default_flag": req.historical_default_flag

}

sample_df = pd.DataFrame([sample])

# 3. 特征工程(与训练时一致,简化版)

# 3.1 还款能力特征

sample_df["debt_service_ratio"] = (sample_df["loan_amount"] / (sample_df["loan_term"] * 12)) * 1.1 / sample_df["income_monthly"]

# 3.2 稳定性特征

sample_df["occupation_stability"] = sample_df["occupation"].map(occupation_stability_map).fillna(0)

# 3.3 标准化连续特征

sample_df[["income_norm", "social_security_years_norm"]] = scaler.transform(

sample_df[["income_monthly", "social_security_years"]]

)

# 3.4 类别特征编码(简化,实际需复用训练时的ohe/le)

sample_df["purpose_dummy"] = 1 if sample_df["purpose"].iloc[0] == "创业资金" else 0 # 示例:仅保留一个虚拟变量

# 4. 特征选择与预测

features = ["income_norm", "debt_service_ratio", "occupation_stability", "social_security_years_norm", "purpose_dummy", "overdue_times_1y", "debt_ratio", "historical_default_flag"]

X_sample = sample_df[features].values

default_prob = model.predict_proba(X_sample)[0][1] # 违约概率

# 5. 构造响应(含风险等级与解释)

risk_level = "高风险" if default_prob > 0.6 else "中风险" if default_prob > 0.3 else "低风险"

response = {

"applicant_id": req.applicant_id,

"default_probability": round(default_prob, 4), # 违约概率(0-1)

"risk_level": risk_level,

"key_factors": [ # 基于逻辑回归系数的关键因素(示例)

{"factor": "负债比", "impact": "正向影响", "coefficient": 0.85},

{"factor": "社保缴纳年限", "impact": "负向影响", "coefficient": -0.62}

],

"timestamp": pd.Timestamp.now().isoformat()

}

return jsonify(response), 200

except Exception as e:

logger.error(f"预测失败:{str(e)}", exc_info=True)

return jsonify({"error": str(e)}), 400

if __name__ == "__main__":

app.run(host="0.0.0.0", port=5000, debug=False) # 生产环境用Gunicorn部署容器化部署

dockerfile

FROM python:3.9-slim

WORKDIR /app

COPY requirements.txt .

RUN pip install --no-cache-dir -r requirements.txt

COPY src/ ./src/

COPY model/ ./model/

EXPOSE 5000

CMD ["gunicorn", "--workers", "4", "--bind", "0.0.0.0:5000", "src.api.app:app"] # 4个工作进程Nginx配置(负载均衡)

nginx

upstream credit_risk_api {

server 10.0.0.1:5000; # 容器1

server 10.0.0.2:5000; # 容器2

}

server {

listen 80;

location /predict_risk {

proxy_pass http://credit_risk_api;

proxy_set_header Host $host;

}

}示例调用API

bash

curl -X POST http://credit-risk-api/predict_risk \

-H "Content-Type: application/json" \

-d '{

"applicant_id": "APP005",

"age": 32,

"occupation": "互联网",

"income_monthly": 18000,

"loan_amount": 250000,

"loan_term": 48,

"purpose": "购房装修",

"overdue_times_1y": 1,

"debt_ratio": 0.55,

"social_security_years": 6,

"historical_default_flag": 0

}'