🍊作者:计算机毕设匠心工作室

🍊简介:毕业后就一直专业从事计算机软件程序开发,至今也有8年工作经验。擅长Java、Python、微信小程序、安卓、大数据、PHP、.NET|C#、Golang等。

擅长:按照需求定制化开发项目、 源码、对代码进行完整讲解、文档撰写、ppt制作。

🍊心愿:点赞 👍 收藏 ⭐评论 📝

👇🏻 精彩专栏推荐订阅 👇🏻 不然下次找不到哟~

Java实战项目

Python实战项目

微信小程序|安卓实战项目

大数据实战项目

PHP|C#.NET|Golang实战项目🍅 ↓↓文末获取源码联系↓↓🍅

这里写目录标题

- 在线教育投融资大数据可视化分析系统-选题背景

- 在线教育投融资大数据可视化分析系统-技术选型

- 在线教育投融资大数据可视化分析系统-视频展示

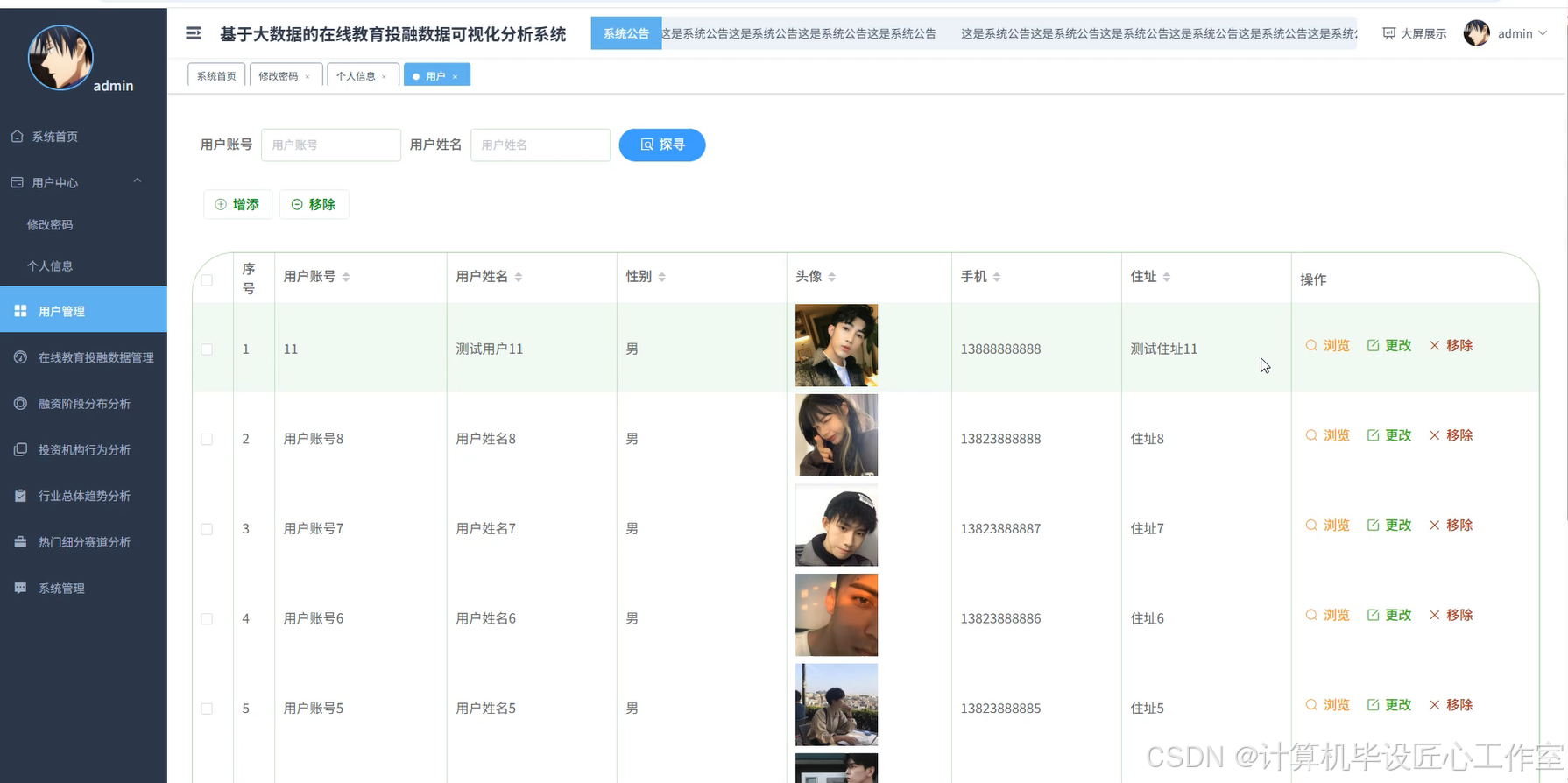

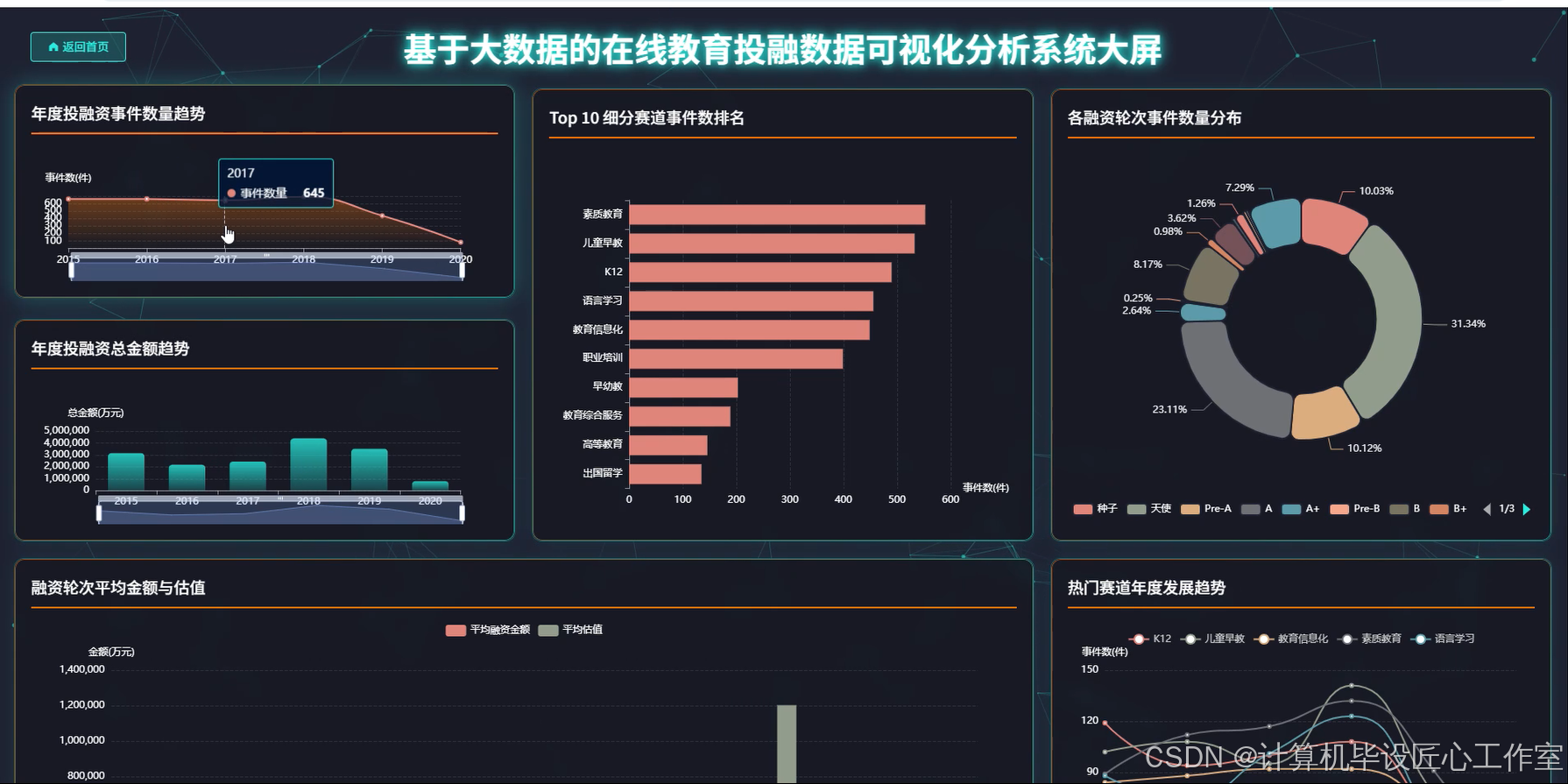

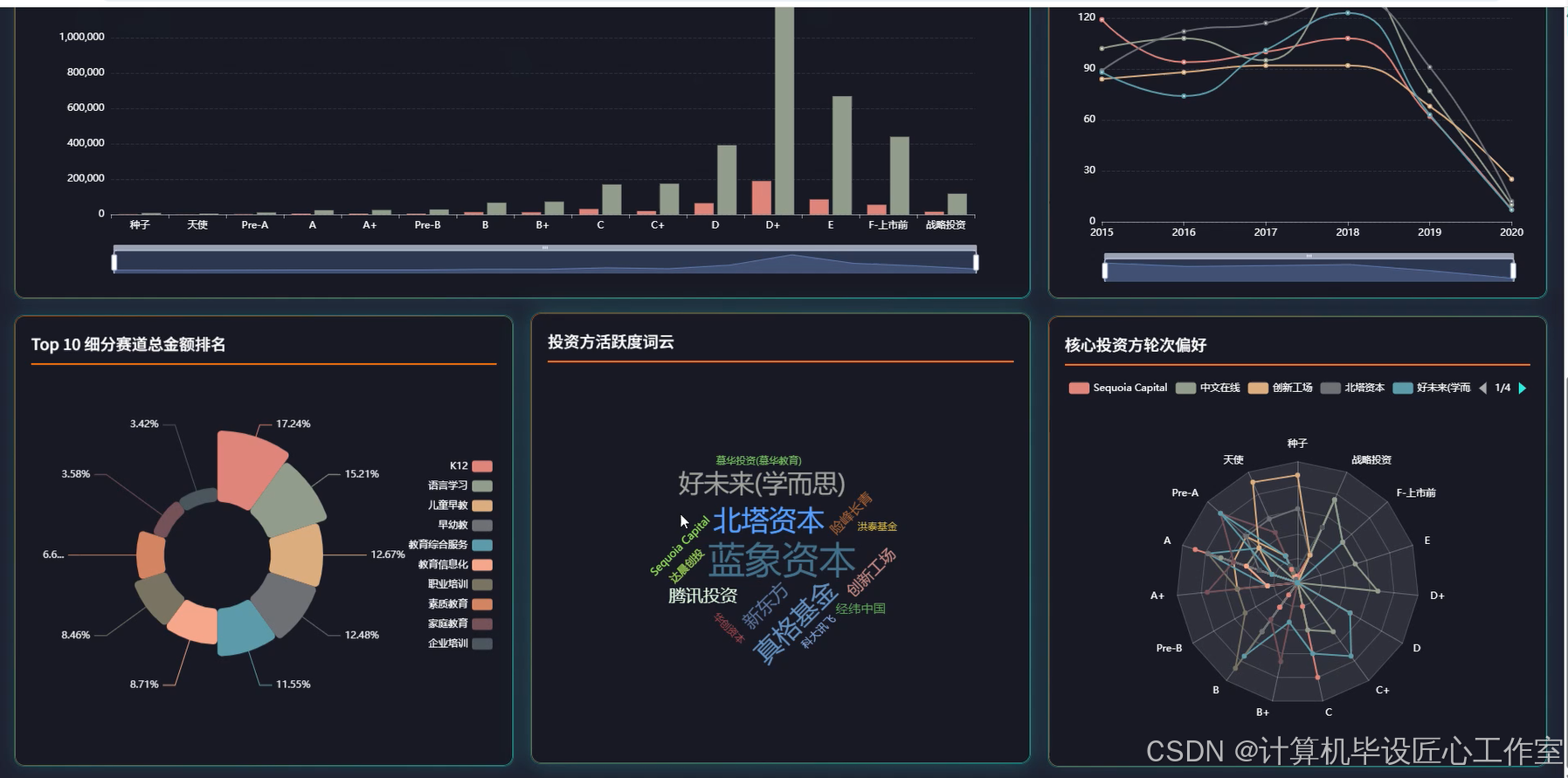

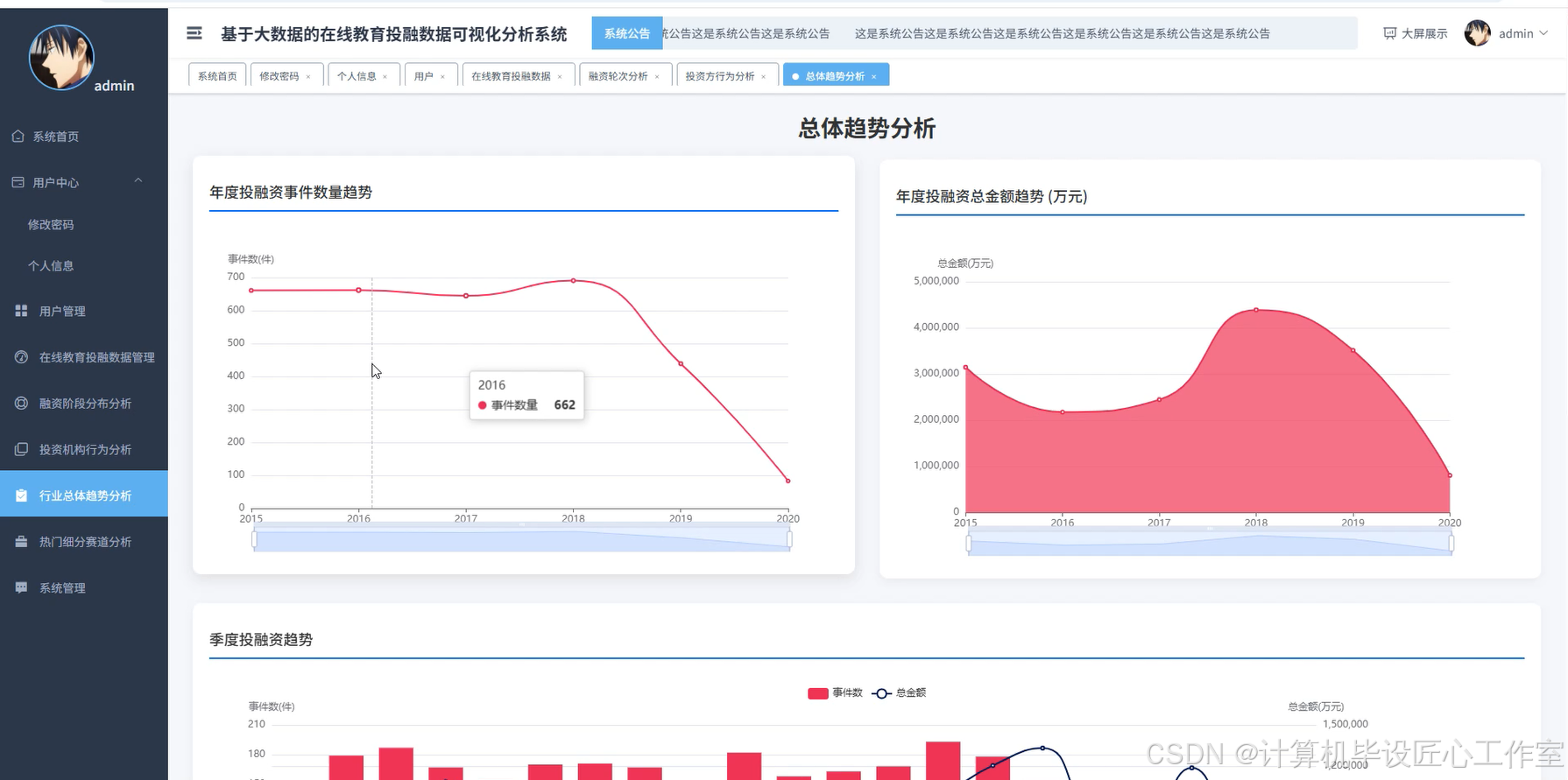

- 在线教育投融资大数据可视化分析系统-图片展示

- 在线教育投融资大数据可视化分析系统-代码展示

- 在线教育投融资大数据可视化分析系统-结语

在线教育投融资大数据可视化分析系统-选题背景

选题背景

近年来,中国在线教育产业经历了前所未有的快速发展与深度变革。从平均投融资金额来看,2020年,在线教育行业的平均融资额达4.86亿元,较2019年增长了5倍以上,达到2016年以来的最大值,这一数字充分展现了资本市场对在线教育赛道的高度关注。与此同时,从融资轮次分布情况来看,中国在线教育行业投资资金逐渐向中后期市场转移,2015年,中国在线教育行业投融资前期轮次占比为80.61%,中后期占比为19.39%;到2020年,在线教育投融资中后期占比已达到46.36%,近乎占据半数。然而,2020年,疫情催热线上经济,在线教育行业被按下"快进键"。高额投资涌入在线教育赛道,头部企业掀起上市热潮,但随后政策调整带来了行业格局的重大转变。这种大起大落的发展轨迹,使得深入分析2015-2020年在线教育投融资数据变得极具研究价值,能够帮助我们理解这个新兴产业在关键发展期的资本流动规律、赛道热度变迁以及投资机构的策略选择。

选题意义

本课题的研究意义体现在多个层面,为相关利益方提供重要参考价值。对于投资机构而言,通过大数据技术深度挖掘历史投融资数据,能够清晰识别不同教育细分赛道的发展潜力和投资回报特征,帮助制定更加精准的投资策略和风险控制措施。对于教育创业者来说,系统化的投融资趋势分析可以指导他们选择合适的融资时机、确定最优的商业模式,同时了解各轮次融资的市场环境和投资方偏好,从而提高融资成功率。从政府监管角度看,本研究提供的数据洞察有助于相关部门掌握在线教育产业的资本流向和发展态势,为制定更加科学合理的行业监管政策提供数据支撑。学术研究方面,本课题将大数据技术与教育产业分析相结合,为后续相关研究提供了技术范式和数据基础,推动了跨学科研究的深入发展。同时,在技术层面,本系统展现了Hadoop、Spark等大数据技术栈在实际商业场景中的应用价值,为大数据技术的产业化应用提供了典型案例,也为类似的数据分析平台建设提供了可借鉴的技术路径。

在线教育投融资大数据可视化分析系统-技术选型

大数据框架:Hadoop+Spark(本次没用Hive,支持定制)

开发语言:Python+Java(两个版本都支持)

后端框架:Django+Spring Boot(Spring+SpringMVC+Mybatis)(两个版本都支持)

前端:Vue+ElementUI+Echarts+HTML+CSS+JavaScript+jQuery

详细技术点:Hadoop、HDFS、Spark、Spark SQL、Pandas、NumPy

数据库:MySQL

在线教育投融资大数据可视化分析系统-视频展示

完整技术栈分享:基于Hadoop+Spark的在线教育投融资大数据可视化分析系统

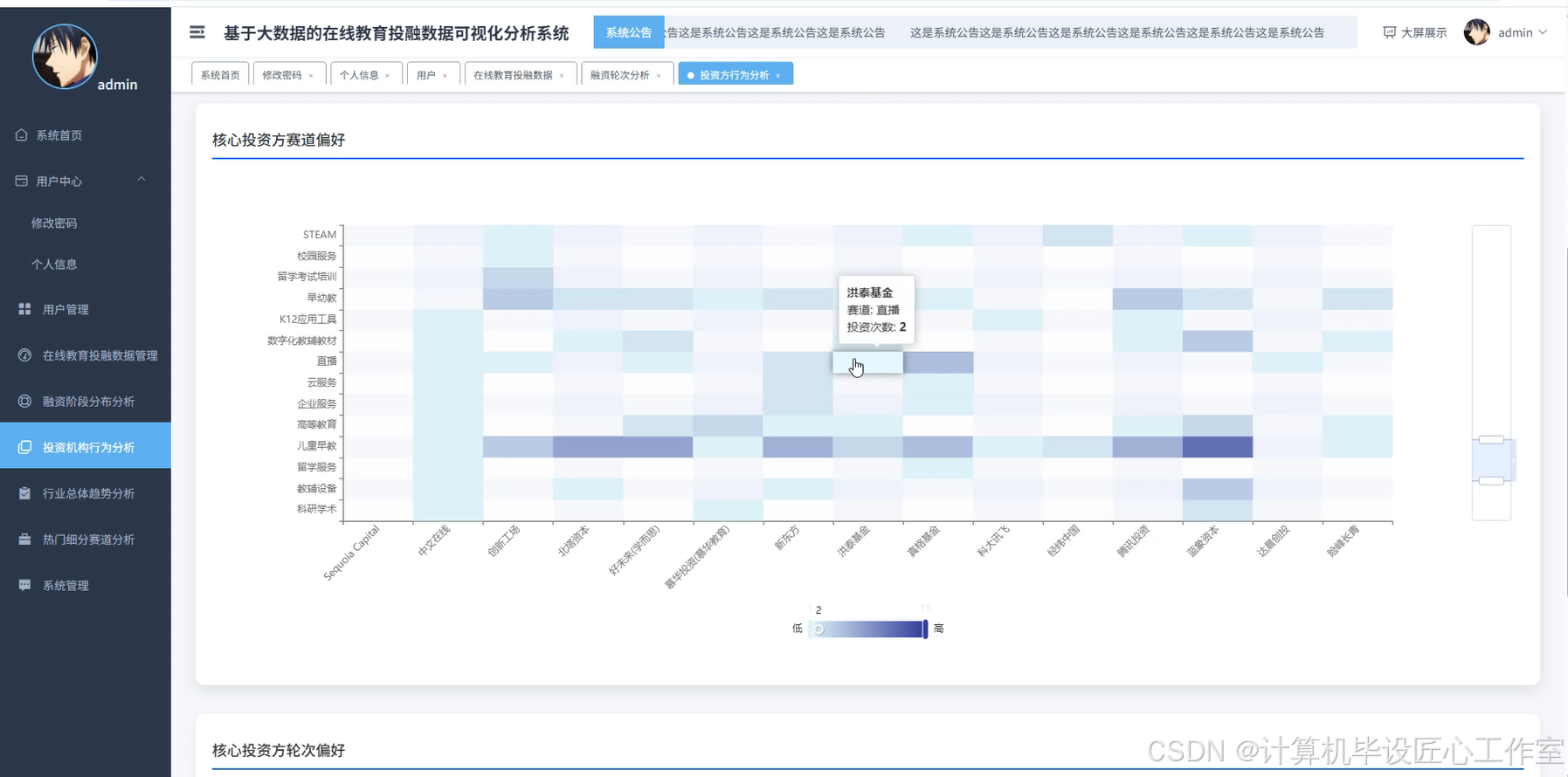

在线教育投融资大数据可视化分析系统-图片展示

在线教育投融资大数据可视化分析系统-代码展示

python

# 基于大数据的在线教育投融数据可视化分析系统 - 核心功能代码

# 功能1:在线教育投融资总体趋势分析

def analyze_investment_trends(request):

connection = get_connection()

cursor = connection.cursor()

# 查询年度投融资事件数量和总金额

yearly_stats_query = """

SELECT YEAR(date) as year, COUNT(*) as event_count,

SUM(amount_rmb) as total_amount

FROM investment_data

WHERE date BETWEEN '2015-01-01' AND '2020-12-31'

GROUP BY YEAR(date)

ORDER BY year

"""

cursor.execute(yearly_stats_query)

yearly_data = cursor.fetchall()

# 计算同比增长率

trend_analysis = []

for i, (year, count, amount) in enumerate(yearly_data):

growth_rate_count = 0

growth_rate_amount = 0

if i > 0:

prev_count = yearly_data[i-1][1]

prev_amount = yearly_data[i-1][2]

growth_rate_count = ((count - prev_count) / prev_count) * 100 if prev_count > 0 else 0

growth_rate_amount = ((amount - prev_amount) / prev_amount) * 100 if prev_amount > 0 else 0

trend_analysis.append({

'year': year,

'event_count': count,

'total_amount': amount,

'count_growth_rate': round(growth_rate_count, 2),

'amount_growth_rate': round(growth_rate_amount, 2)

})

# 季度数据分析

quarterly_query = """

SELECT YEAR(date) as year, QUARTER(date) as quarter,

COUNT(*) as event_count, SUM(amount_rmb) as total_amount

FROM investment_data

WHERE date BETWEEN '2015-01-01' AND '2020-12-31'

GROUP BY YEAR(date), QUARTER(date)

ORDER BY year, quarter

"""

cursor.execute(quarterly_query)

quarterly_data = cursor.fetchall()

quarterly_analysis = []

for year, quarter, count, amount in quarterly_data:

quarterly_analysis.append({

'period': f"{year}Q{quarter}",

'year': year,

'quarter': quarter,

'event_count': count,

'total_amount': amount,

'avg_amount_per_deal': round(amount / count, 2) if count > 0 else 0

})

cursor.close()

connection.close()

response_data = {

'yearly_trends': trend_analysis,

'quarterly_trends': quarterly_analysis,

'market_summary': {

'total_events': sum(item['event_count'] for item in trend_analysis),

'total_investment': sum(item['total_amount'] for item in trend_analysis),

'peak_year': max(trend_analysis, key=lambda x: x['total_amount'])['year'],

'highest_growth_year': max(trend_analysis[1:], key=lambda x: x['amount_growth_rate'])['year']

}

}

return JsonResponse(response_data, safe=False)

# 功能2:细分赛道投融资热度分析

def analyze_sector_trends(request):

connection = get_connection()

cursor = connection.cursor()

# 各细分赛道投融资事件统计

sector_stats_query = """

SELECT tags, COUNT(*) as event_count,

SUM(amount_rmb) as total_amount,

AVG(amount_rmb) as avg_amount

FROM investment_data

WHERE tags IS NOT NULL AND tags != ''

GROUP BY tags

ORDER BY total_amount DESC

"""

cursor.execute(sector_stats_query)

sector_data = cursor.fetchall()

sector_analysis = []

total_events = sum(item[1] for item in sector_data)

total_amount = sum(item[2] for item in sector_data)

for tags, count, amount, avg_amount in sector_data:

sector_analysis.append({

'sector': tags,

'event_count': count,

'total_amount': amount,

'avg_amount': round(avg_amount, 2),

'event_percentage': round((count / total_events) * 100, 2),

'amount_percentage': round((amount / total_amount) * 100, 2)

})

# 热门赛道年度发展趋势

top_sectors = [item['sector'] for item in sector_analysis[:5]]

sector_trends = {}

for sector in top_sectors:

trend_query = """

SELECT YEAR(date) as year, COUNT(*) as event_count,

SUM(amount_rmb) as total_amount

FROM investment_data

WHERE tags = %s AND date BETWEEN '2015-01-01' AND '2020-12-31'

GROUP BY YEAR(date)

ORDER BY year

"""

cursor.execute(trend_query, (sector,))

trend_data = cursor.fetchall()

sector_trends[sector] = []

for year, count, amount in trend_data:

sector_trends[sector].append({

'year': year,

'event_count': count,

'total_amount': amount,

'market_share': round((amount / total_amount) * 100, 2) if total_amount > 0 else 0

})

# 赛道竞争强度分析

competition_analysis = []

for sector_info in sector_analysis:

competition_intensity = sector_info['event_count'] / sector_info['avg_amount'] if sector_info['avg_amount'] > 0 else 0

competition_analysis.append({

'sector': sector_info['sector'],

'competition_intensity': round(competition_intensity, 4),

'maturity_level': 'high' if sector_info['avg_amount'] > 50000000 else 'medium' if sector_info['avg_amount'] > 20000000 else 'low'

})

cursor.close()

connection.close()

response_data = {

'sector_rankings': sector_analysis,

'sector_yearly_trends': sector_trends,

'competition_analysis': sorted(competition_analysis, key=lambda x: x['competition_intensity'], reverse=True),

'market_insights': {

'most_funded_sector': sector_analysis[0]['sector'] if sector_analysis else None,

'most_active_sector': max(sector_analysis, key=lambda x: x['event_count'])['sector'] if sector_analysis else None,

'highest_avg_funding': max(sector_analysis, key=lambda x: x['avg_amount'])['sector'] if sector_analysis else None

}

}

return JsonResponse(response_data, safe=False)

# 功能3:投资机构行为与偏好分析

def analyze_investor_behavior(request):

connection = get_connection()

cursor = connection.cursor()

# 投资机构活跃度和投资总额排名

investor_stats_query = """

SELECT investor, COUNT(*) as investment_count,

SUM(amount_rmb) as total_investment,

AVG(amount_rmb) as avg_investment

FROM investment_data

WHERE investor IS NOT NULL AND investor != ''

GROUP BY investor

HAVING COUNT(*) >= 3

ORDER BY total_investment DESC

LIMIT 15

"""

cursor.execute(investor_stats_query)

investor_data = cursor.fetchall()

investor_rankings = []

for investor, count, total, avg in investor_data:

investor_rankings.append({

'investor_name': investor,

'investment_count': count,

'total_investment': total,

'avg_investment': round(avg, 2),

'investment_efficiency': round(total / count, 2)

})

# 核心投资方赛道偏好分析

top_investors = [item['investor_name'] for item in investor_rankings[:5]]

investor_preferences = {}

for investor in top_investors:

sector_pref_query = """

SELECT tags, COUNT(*) as investment_count,

SUM(amount_rmb) as total_amount

FROM investment_data

WHERE investor = %s AND tags IS NOT NULL AND tags != ''

GROUP BY tags

ORDER BY investment_count DESC

"""

cursor.execute(sector_pref_query, (investor,))

sector_data = cursor.fetchall()

investor_preferences[investor] = {

'sector_distribution': []

}

total_investments = sum(item[1] for item in sector_data)

for tags, count, amount in sector_data:

investor_preferences[investor]['sector_distribution'].append({

'sector': tags,

'investment_count': count,

'total_amount': amount,

'percentage': round((count / total_investments) * 100, 2) if total_investments > 0 else 0

})

# 融资轮次偏好分析

round_pref_query = """

SELECT round, COUNT(*) as investment_count,

SUM(amount_rmb) as total_amount

FROM investment_data

WHERE investor = %s AND round IS NOT NULL AND round != ''

GROUP BY round

ORDER BY investment_count DESC

"""

cursor.execute(round_pref_query, (investor,))

round_data = cursor.fetchall()

investor_preferences[investor]['round_distribution'] = []

total_round_investments = sum(item[1] for item in round_data)

for round_name, count, amount in round_data:

investor_preferences[investor]['round_distribution'].append({

'round': round_name,

'investment_count': count,

'total_amount': amount,

'percentage': round((count / total_round_investments) * 100, 2) if total_round_investments > 0 else 0,

'avg_check_size': round(amount / count, 2) if count > 0 else 0

})

# 投资策略分析

strategy_analysis = {}

for investor_info in investor_rankings[:5]:

investor = investor_info['investor_name']

strategy_query = """

SELECT AVG(valuation_rmb) as avg_valuation,

MIN(date) as earliest_investment,

MAX(date) as latest_investment,

COUNT(DISTINCT tags) as sector_diversity

FROM investment_data

WHERE investor = %s AND valuation_rmb IS NOT NULL

"""

cursor.execute(strategy_query, (investor,))

strategy_data = cursor.fetchone()

if strategy_data:

avg_val, earliest, latest, diversity = strategy_data

investment_period = (latest - earliest).days if earliest and latest else 0

strategy_analysis[investor] = {

'avg_portfolio_valuation': round(avg_val, 2) if avg_val else 0,

'investment_period_days': investment_period,

'sector_diversity_score': diversity,

'investment_style': 'diversified' if diversity >= 5 else 'focused',

'risk_preference': 'high' if investor_info['avg_investment'] > 100000000 else 'medium' if investor_info['avg_investment'] > 50000000 else 'conservative'

}

cursor.close()

connection.close()

response_data = {

'investor_rankings': investor_rankings,

'investor_preferences': investor_preferences,

'strategy_analysis': strategy_analysis,

'market_dynamics': {

'most_active_investor': investor_rankings[0]['investor_name'] if investor_rankings else None,

'largest_investor': max(investor_rankings, key=lambda x: x['total_investment'])['investor_name'] if investor_rankings else None,

'most_efficient_investor': max(investor_rankings, key=lambda x: x['investment_efficiency'])['investor_name'] if investor_rankings else None

}

}

return JsonResponse(response_data, safe=False)在线教育投融资大数据可视化分析系统-结语

👇🏻 精彩专栏推荐订阅 👇🏻 不然下次找不到哟~

Java实战项目

Python实战项目

微信小程序|安卓实战项目

大数据实战项目

PHP|C#.NET|Golang实战项目🍅 主页获取源码联系🍅