目录

[一、Load Data 加载数据](#一、Load Data 加载数据)

[二、Data Prep 数据处理](#二、Data Prep 数据处理)

[三、Fit Model 拟合模型](#三、Fit Model 拟合模型)

[四、Analyze 结果分析](#四、Analyze 结果分析)

一、Load Data 加载数据

1.数据解释

| Variable | Description | Transformation |

|---|---|---|

| realgdp | Real gross domestic product(实际国内生产总值) | Annual Growth Rate(年增长率) |

| realcons | Real personal consumption expenditures(实际个人消费支出) | Annual Growth Rate(年增长率) |

| realinv | Real gross private domestic investment(实际私人国内总投资) | Annual Growth Rate(年增长率) |

| realgovt | Real federal expenditures & gross investment(实际联邦政府支出与总投资) | Annual Growth Rate(年增长率) |

| realdpi | Real private disposable income(实际私人可支配收入) | Annual Growth Rate(年增长率) |

| m1 | M1 nominal money stock(名义M1货币供应量) | Annual Growth Rate(年增长率) |

| tbilrate | Monthly treasury bill rate(月度国库券利率) | Level(水平值) |

| unemp | Seasonally adjusted unemployment rate (%)(季调失业率,单位:%) | Level(水平值) |

| infl | Inflation rate(通货膨胀率) | Level(水平值) |

| realint | Real interest rate(实际利率) | Level(水平值) |

通过

import statsmodels.api as sm

data = pd.DataFrame(sm.datasets.macrodata.load().data)

下载宏观数据,这里应该指的是美国的

2.代码

python

%matplotlib inline

import pandas as pd

import statsmodels.api as sm

import matplotlib.pyplot as plt

import seaborn as sns

sns.set_style('whitegrid')

data = pd.DataFrame(sm.datasets.macrodata.load().data)

data.info()

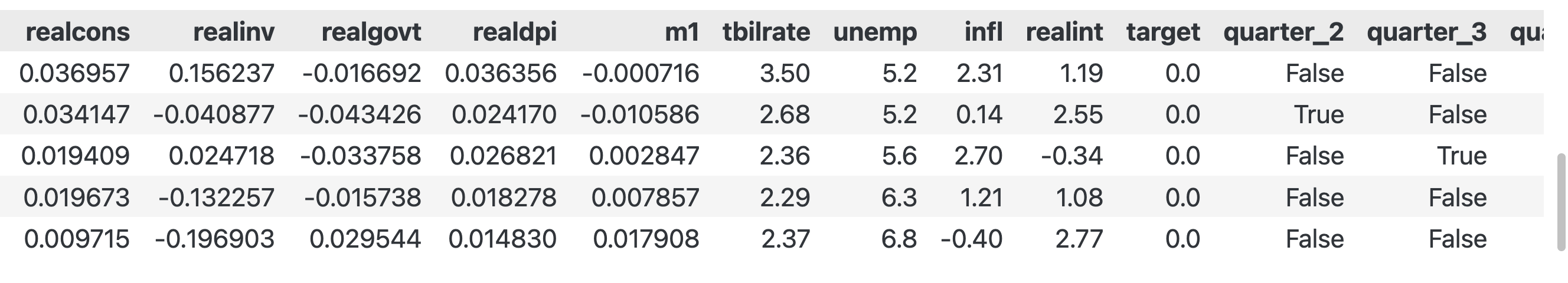

data.head()结果:

python

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 203 entries, 0 to 202

Data columns (total 14 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 year 203 non-null float64

1 quarter 203 non-null float64

2 realgdp 203 non-null float64

3 realcons 203 non-null float64

4 realinv 203 non-null float64

5 realgovt 203 non-null float64

6 realdpi 203 non-null float64

7 cpi 203 non-null float64

8 m1 203 non-null float64

9 tbilrate 203 non-null float64

10 unemp 203 non-null float64

11 pop 203 non-null float64

12 infl 203 non-null float64

13 realint 203 non-null float64

dtypes: float64(14)

memory usage: 22.3 KB数据格式:

二、Data Prep 数据处理

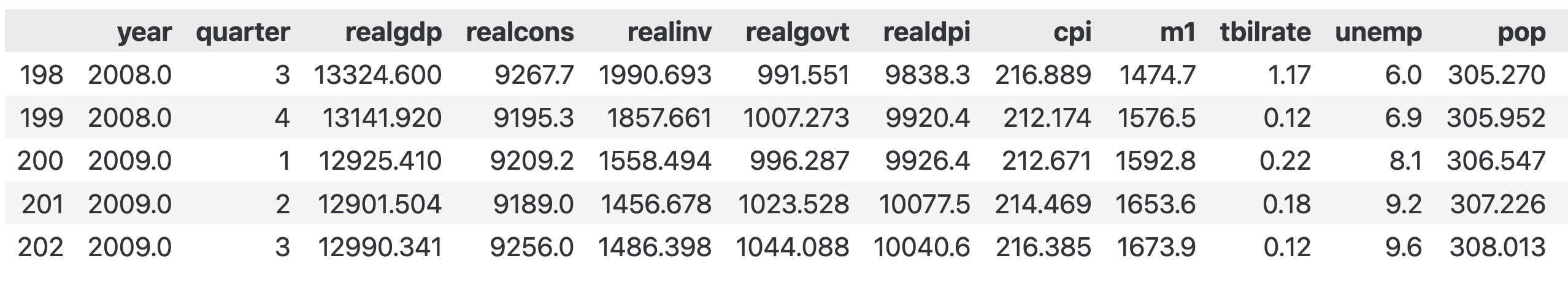

为了获得一个二元目标变量,我们计算季度实际GDP年增长率的20个季度滚动平均值。然后,如果当前增长超过移动平均值,++我们将其分配为1,否则分配为0++。最后,我们移动指标变量,使下一季度的结果与当前季度对齐。

To obtain a binary target variable, we compute the 20-quarter rolling average of the annual growth rate of quarterly real GDP. We then assign 1 if current growth exceeds the moving average and 0 otherwise. Finally, we shift the indicator variables to align next quarter's outcome with the current quarter.

python

data['growth_rate'] = data.realgdp.pct_change(4)

data['target'] = (data.growth_rate > data.growth_rate.rolling(20).mean()).astype(int).shift(-1)

data.quarter = data.quarter.astype(int)

data.target.value_counts()

data.tail()

python

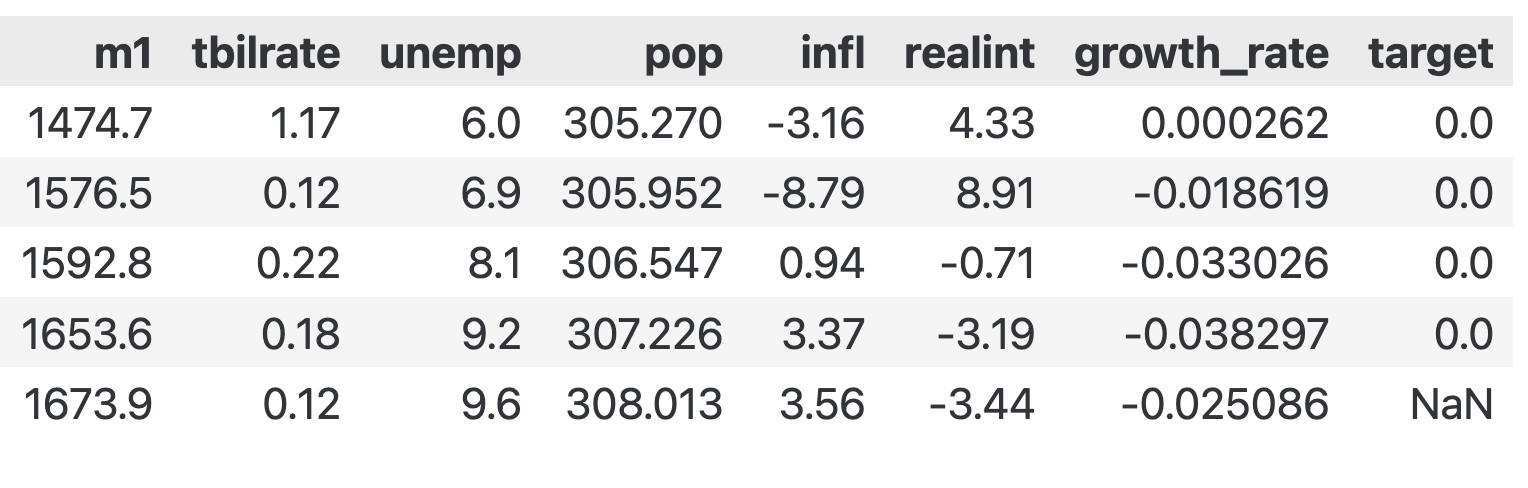

pct_cols = ['realcons', 'realinv', 'realgovt', 'realdpi', 'm1']

drop_cols = ['year', 'realgdp', 'pop', 'cpi', 'growth_rate']

data.loc[:, pct_cols] = data.loc[:, pct_cols].pct_change(4)

data = pd.get_dummies(data.drop(drop_cols, axis=1), columns=['quarter'], drop_first=True).dropna()

data.info()

data.head()

python

<class 'pandas.core.frame.DataFrame'>

Index: 198 entries, 4 to 201

Data columns (total 13 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 realcons 198 non-null float64

1 realinv 198 non-null float64

2 realgovt 198 non-null float64

3 realdpi 198 non-null float64

4 m1 198 non-null float64

5 tbilrate 198 non-null float64

6 unemp 198 non-null float64

7 infl 198 non-null float64

8 realint 198 non-null float64

9 target 198 non-null float64

10 quarter_2 198 non-null bool

11 quarter_3 198 non-null bool

12 quarter_4 198 non-null bool

dtypes: bool(3), float64(10)

memory usage: 17.6 KB

三、Fit Model 拟合模型

python

# model = sm.Logit(data.target, sm.add_constant(data.drop('target', axis=1))) # bad code

model = sm.Logit(data.target, sm.add_constant(data.drop('target', axis=1).astype(float)))

result = model.fit()

result.summary()注意,原作者代码已经失效,要加上数据转换才行:

model = sm.Logit(data.target, sm.add_constant(data.drop('target', axis=1))) # bad code

model = sm.Logit(data.target, sm.add_constant(data.drop('target', axis=1).astype(float)))

结果:

Optimization terminated successfully. Current function value: 0.342965 Iterations 8

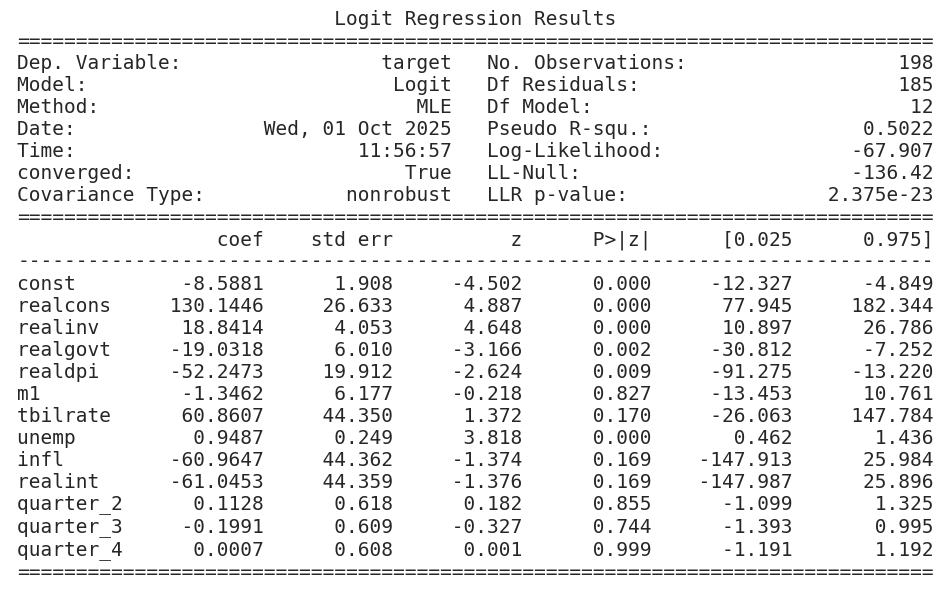

| Dep. Variable: | target | No. Observations: | 198 |

| Model: | Logit | Df Residuals: | 185 |

| Method: | MLE | Df Model: | 12 |

| Date: | Wed, 01 Oct 2025 | Pseudo R-squ.: | 0.5022 |

| Time: | 11:27:45 | Log-Likelihood: | -67.907 |

| converged: | True | LL-Null: | -136.42 |

| Covariance Type: | nonrobust | LLR p-value: | 2.375e-23 |

|---|---|---|---|

| [Logit Regression Results] |

|---|------|---------|---|----------|---------|---------|

| | coef | std err | z | P>|z| | [0.025 | 0.975] |

四、Analyze 结果分析

McFadden Pseudo R² = 0.50, 模型效果还不错。

我们使用截距并将季度值转换为虚拟变量,并按照以下方式训练逻辑回归模型:

这为我们的模型生成了以下摘要,该模型有198个观测值和13个变量(注:12个变量+截距=13),包括截距:

摘要表明,该模型已使用最大似然法进行训练,并提供对数似然函数在-67.9处的最大值。

We use an intercept and convert the quarter values to dummy variables and train the logistic regression model as follows:

This produces the following summary for our model with 198 observations and 13 variables, including intercept: The summary indicates that the model has been trained using maximum likelihood and provides the maximized value of the log-likelihood function at -67.9.

python

plt.rc('figure', figsize=(12, 7))

plt.text(0.01, 0.05, str(result.summary()), {'fontsize': 14}, fontproperties = 'monospace')

plt.axis('off')

plt.tight_layout()

plt.subplots_adjust(left=0.2, right=0.8, top=0.8, bottom=0.1)

plt.savefig('logistic_example.png', bbox_inches='tight', dpi=300);