目录

[一、Load Data 加载数据](#一、Load Data 加载数据)

[二、Explore Data 探索数据](#二、Explore Data 探索数据)

[三、OLS analysis 普通最小二乘分析](#三、OLS analysis 普通最小二乘分析)

[1-Day Returns](#1-Day Returns)

[5-Day Returns](#5-Day Returns)

[四、Obtain the residuals 计算残差](#四、Obtain the residuals 计算残差)

[residuals analysis 残差分析](#residuals analysis 残差分析)

[10-Day Returns](#10-Day Returns)

[Monthly Returns](#Monthly Returns)

Statistical inference of stock returns with linear regression

这些需要先从0703中构建数据,然后再这一篇。

一、Load Data 加载数据

python

import warnings

warnings.filterwarnings('ignore')

%matplotlib inline

import pandas as pd

from statsmodels.api import OLS, add_constant, graphics

from statsmodels.graphics.tsaplots import plot_acf

from scipy.stats import norm

import seaborn as sns

import matplotlib.pyplot as plt

sns.set_style('whitegrid')

idx = pd.IndexSlice

python

# Load Data

with pd.HDFStore('data.h5') as store:

data = (store['model_data']

.dropna()

.drop(['open', 'close', 'low', 'high'], axis=1))

# Select Investment Universe

data = data[data.dollar_vol_rank<100]

data.info(show_counts=True)输出:

python

<class 'pandas.core.frame.DataFrame'>

MultiIndex: 109434 entries, ('AAL', Timestamp('2013-07-26 00:00:00')) to ('YUM', Timestamp('2015-11-03 00:00:00'))

Data columns (total 65 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 volume 109434 non-null float64

1 dollar_vol 109434 non-null float64

2 dollar_vol_1m 109434 non-null float64

3 dollar_vol_rank 109434 non-null float64

4 rsi 109434 non-null float64

5 bb_high 109434 non-null float64

6 bb_low 109434 non-null float64

7 atr 109434 non-null float64

8 macd 109434 non-null float64

9 return_1d 109434 non-null float64

10 return_5d 109434 non-null float64

11 return_10d 109434 non-null float64

12 return_21d 109434 non-null float64

13 return_42d 109434 non-null float64

14 return_63d 109434 non-null float64

15 return_1d_lag1 109434 non-null float64

16 return_5d_lag1 109434 non-null float64

17 return_10d_lag1 109434 non-null float64

18 return_21d_lag1 109434 non-null float64

19 return_1d_lag2 109434 non-null float64

20 return_5d_lag2 109434 non-null float64

21 return_10d_lag2 109434 non-null float64

22 return_21d_lag2 109434 non-null float64

23 return_1d_lag3 109434 non-null float64

24 return_5d_lag3 109434 non-null float64

25 return_10d_lag3 109434 non-null float64

26 return_21d_lag3 109434 non-null float64

27 return_1d_lag4 109434 non-null float64

28 return_5d_lag4 109434 non-null float64

29 return_10d_lag4 109434 non-null float64

30 return_21d_lag4 109434 non-null float64

31 return_1d_lag5 109434 non-null float64

32 return_5d_lag5 109434 non-null float64

33 return_10d_lag5 109434 non-null float64

34 return_21d_lag5 109434 non-null float64

35 target_1d 109434 non-null float64

36 target_5d 109434 non-null float64

37 target_10d 109434 non-null float64

38 target_21d 109434 non-null float64

39 year_2014 109434 non-null bool

40 year_2015 109434 non-null bool

41 year_2016 109434 non-null bool

42 year_2017 109434 non-null bool

43 month_2 109434 non-null bool

44 month_3 109434 non-null bool

45 month_4 109434 non-null bool

46 month_5 109434 non-null bool

47 month_6 109434 non-null bool

48 month_7 109434 non-null bool

49 month_8 109434 non-null bool

50 month_9 109434 non-null bool

51 month_10 109434 non-null bool

52 month_11 109434 non-null bool

53 month_12 109434 non-null bool

54 capital_goods 109434 non-null bool

55 consumer_durables 109434 non-null bool

56 consumer_non-durables 109434 non-null bool

57 consumer_services 109434 non-null bool

58 energy 109434 non-null bool

59 finance 109434 non-null bool

60 health_care 109434 non-null bool

61 miscellaneous 109434 non-null bool

62 public_utilities 109434 non-null bool

63 technology 109434 non-null bool

64 transportation 109434 non-null bool

dtypes: bool(26), float64(39)

memory usage: 36.5+ MBCreate Model Data

python

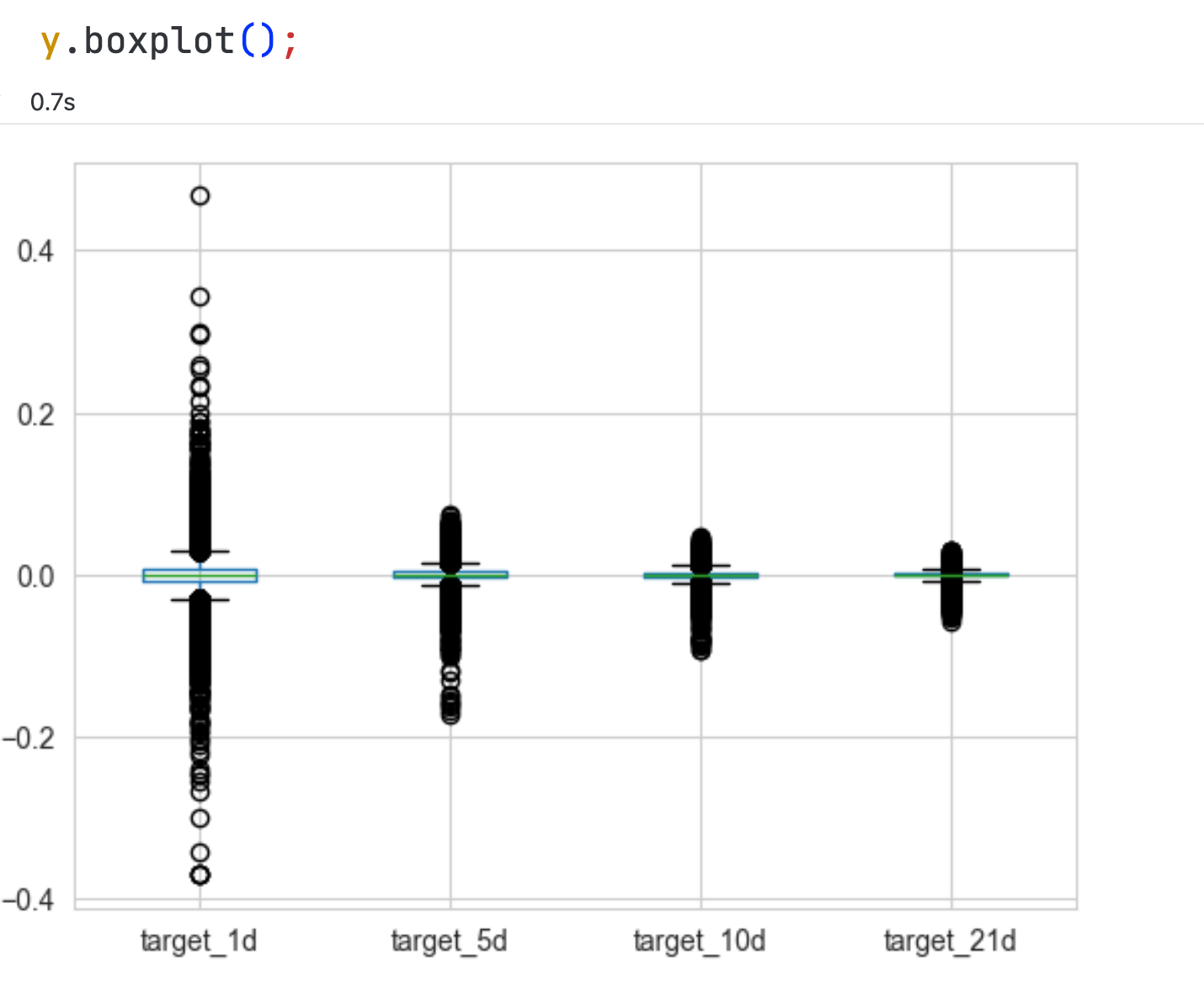

y = data.filter(like='target')

X = data.drop(y.columns, axis=1)

X = X.drop(['dollar_vol', 'dollar_vol_rank', 'volume', 'consumer_durables'], axis=1)如果这里报错的话,要修改上一节0704的代码:

python

prices['sector'] = prices['sector'].str.lower().str.replace(' ', '_') # add code;增加的代码

prices.assign(sector=pd.factorize(prices.sector, sort=True)[0]).to_hdf('data.h5', 'model_data/no_dummies')

prices = pd.get_dummies(prices,

columns=['year', 'month', 'sector'],

prefix=['year', 'month', ''],

prefix_sep=['_', '_', ''],

drop_first=True)

prices.info(show_counts=True)二、Explore Data 探索数据

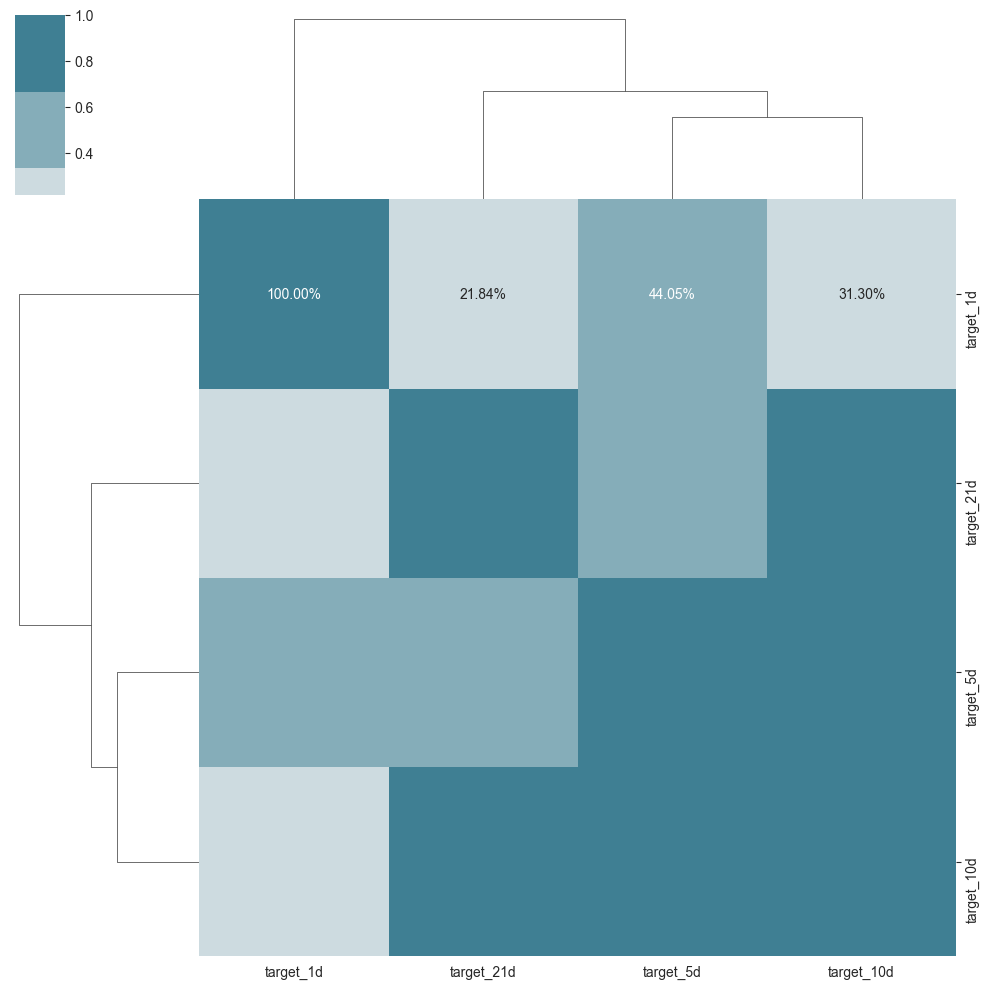

python

sns.clustermap(y.corr(), cmap=sns.diverging_palette(h_neg=20, h_pos=220), center=0, annot=True, fmt='.2%');

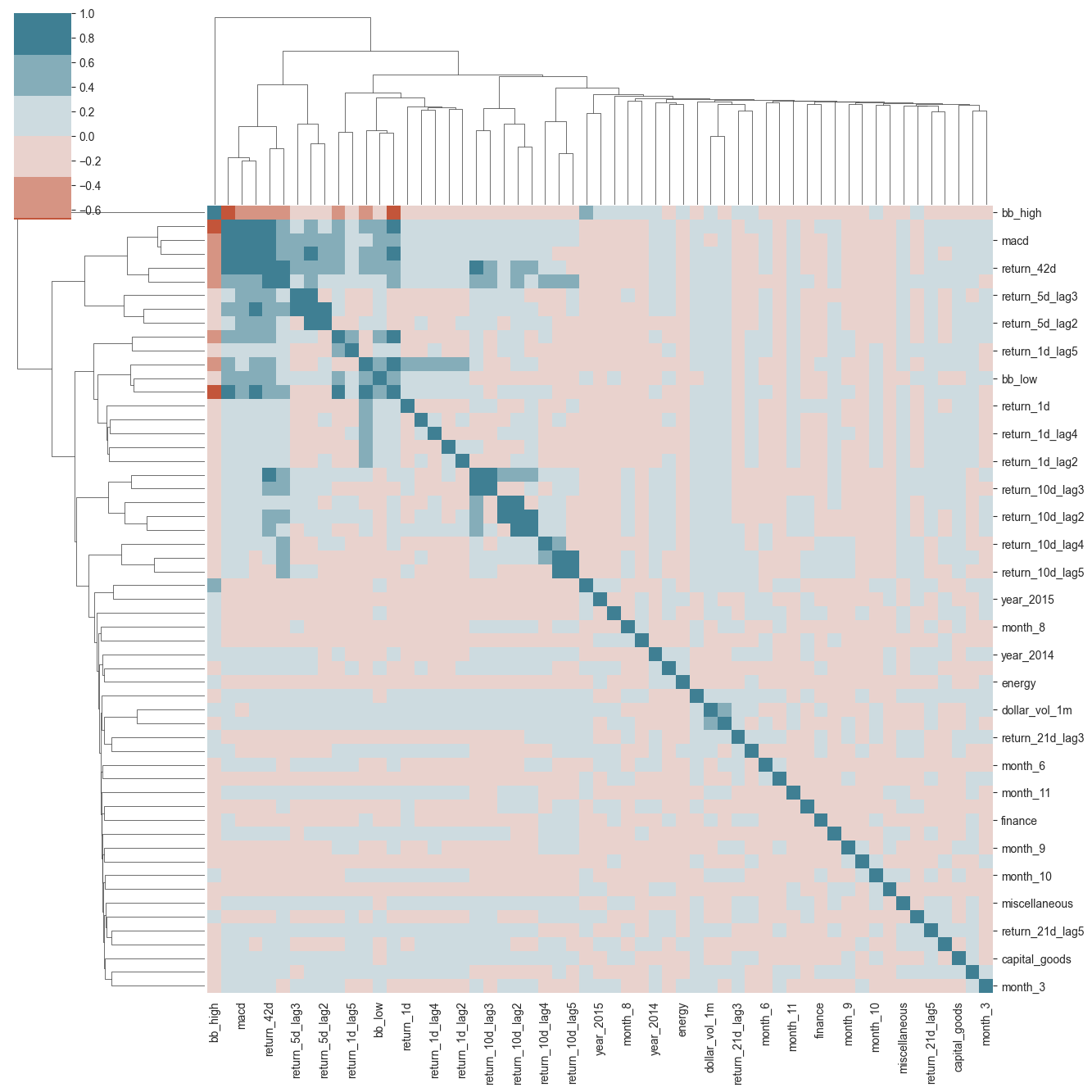

python

sns.clustermap(X.corr(), cmap=sns.diverging_palette(h_neg=20, h_pos=220), center=0);

plt.gcf().set_size_inches((14, 14))

热力图结论:

热力图显示了特征之间的相关性。

相关系数的范围在-1到1之间,值越接近1或-1,说明特征之间的相关性越强。

相关系数为0说明特征之间没有相关性。

Conclusion of heat map:

The heatmap shows the correlation between features.

The range of the correlation coefficient is between -1 and 1. The closer the value is to 1 or -1, the stronger the correlation between the features.

A correlation coefficient of 0 indicates that there is no correlation between the features.

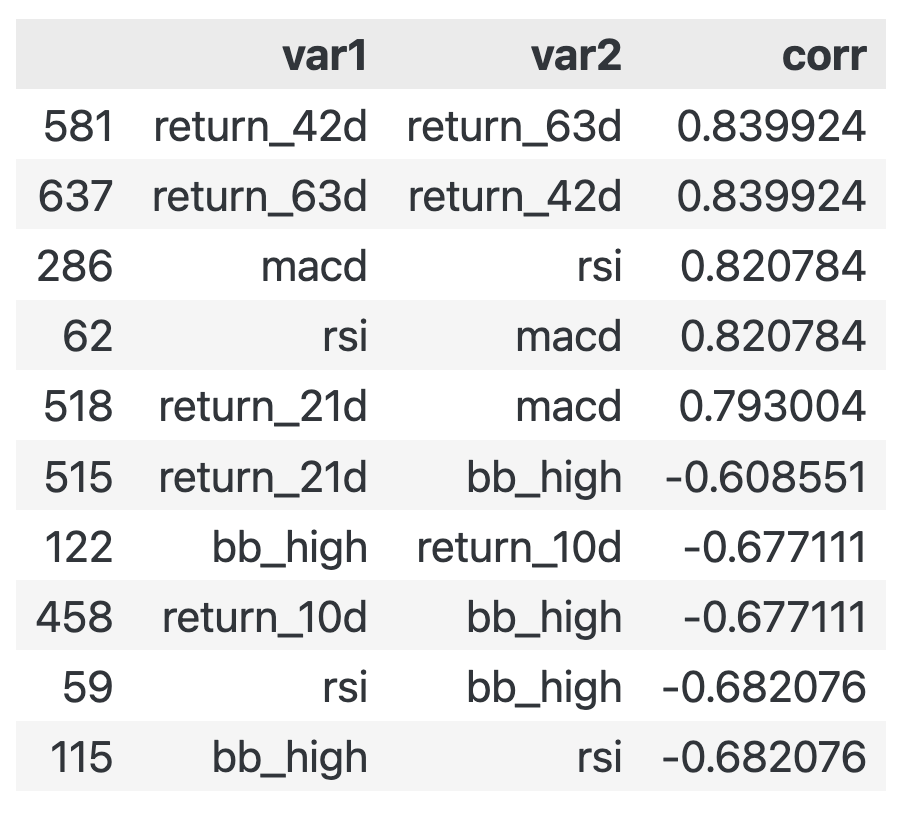

python

corr_mat = X.corr().stack().reset_index()

corr_mat.columns=['var1', 'var2', 'corr']

corr_mat = corr_mat[corr_mat.var1!=corr_mat.var2].sort_values(by='corr', ascending=False)

# corr_mat.head().append(corr_mat.tail()) old code is bad; 作者原始代码已经不行了

pd.concat([corr_mat.head(), corr_mat.tail()]) # pandas ≥ 2.0 good

三、OLS analysis 普通最小二乘分析

Linear Regression for Statistical Inference: OLS with statsmodels

用statsmodels库进行线性回归分析,OLS线性回归

Ticker-wise standardization

statsmodels warns of high design matrix condition numbers. This can arise when the variables are not standardized and the Eigenvalues differ due to scaling. The following step avoids this warning.

python

sectors = X.iloc[:, -10:]

X = (X.drop(sectors.columns, axis=1)

.groupby(level='ticker')

.transform(lambda x: (x - x.mean()) / x.std())

.join(sectors)

.fillna(0))1-Day Returns

python

target = 'target_1d'

# this is MultiIndex

# model = OLS(endog=y[target], exog=add_constant(X)) # old code is bad; 老代码失效

X = X.astype(float)

model = OLS(endog=y[target], exog=add_constant(X)) # this is good.

trained_model = model.fit()

print(trained_model.summary())

# R-squared is only 0.009, less than 0.5; bad输出:

(R方值比较小的,低于0.5,说明拟合不好)

python

OLS Regression Results

==============================================================================

Dep. Variable: target_1d R-squared: 0.009

Model: OLS Adj. R-squared: 0.009

Method: Least Squares F-statistic: 18.36

Date: Sun, 28 Sep 2025 Prob (F-statistic): 5.52e-181

Time: 14:20:47 Log-Likelihood: 2.8809e+05

No. Observations: 109434 AIC: -5.761e+05

Df Residuals: 109376 BIC: -5.755e+05

Df Model: 57

Covariance Type: nonrobust

=========================================================================================

coef std err t P>|t| [0.025 0.975]

-----------------------------------------------------------------------------------------

const 8.573e-05 0.000 0.543 0.587 -0.000 0.000

dollar_vol_1m -0.0004 6.78e-05 -5.392 0.000 -0.000 -0.000

rsi 0.0001 0.000 0.758 0.449 -0.000 0.001

bb_high 0.0002 0.000 0.759 0.448 -0.000 0.001

bb_low 0.0006 0.000 2.717 0.007 0.000 0.001

atr 2.421e-06 7.35e-05 0.033 0.974 -0.000 0.000

macd -0.0004 0.000 -1.764 0.078 -0.001 4.68e-05

return_1d 0.0024 0.000 8.693 0.000 0.002 0.003

return_5d -0.0010 0.001 -1.151 0.250 -0.003 0.001

return_10d -0.0061 0.001 -6.641 0.000 -0.008 -0.004

return_21d 0.0024 0.000 5.552 0.000 0.002 0.003

return_42d -0.0035 0.001 -6.605 0.000 -0.005 -0.002

return_63d -0.0015 0.000 -3.711 0.000 -0.002 -0.001

return_1d_lag1 0.0022 0.000 7.945 0.000 0.002 0.003

return_5d_lag1 0.0047 0.001 7.420 0.000 0.003 0.006

return_10d_lag1 -0.0007 0.001 -0.639 0.523 -0.003 0.001

return_21d_lag1 0.0025 0.000 6.952 0.000 0.002 0.003

return_1d_lag2 0.0023 0.000 8.058 0.000 0.002 0.003

return_5d_lag2 0.0007 0.001 1.022 0.307 -0.001 0.002

return_10d_lag2 -0.0002 0.001 -0.193 0.847 -0.002 0.001

return_21d_lag2 -6.892e-05 0.000 -0.250 0.802 -0.001 0.000

return_1d_lag3 0.0022 0.000 7.804 0.000 0.002 0.003

return_5d_lag3 0.0013 0.001 1.807 0.071 -0.000 0.003

return_10d_lag3 0.0006 0.000 4.431 0.000 0.000 0.001

return_21d_lag3 -0.0003 5.57e-05 -4.564 0.000 -0.000 -0.000

return_1d_lag4 0.0025 0.000 8.871 0.000 0.002 0.003

return_5d_lag4 0.0009 0.001 1.511 0.131 -0.000 0.002

return_10d_lag4 0.0005 0.000 4.674 0.000 0.000 0.001

return_21d_lag4 -8.646e-07 5.51e-05 -0.016 0.987 -0.000 0.000

return_1d_lag5 -9.493e-05 6.16e-05 -1.540 0.123 -0.000 2.59e-05

return_5d_lag5 0.0004 0.001 0.692 0.489 -0.001 0.001

return_10d_lag5 0.0008 9.86e-05 7.792 0.000 0.001 0.001

return_21d_lag5 0.0001 5.48e-05 2.023 0.043 3.44e-06 0.000

year_2014 -0.0003 8.28e-05 -4.111 0.000 -0.001 -0.000

year_2015 -0.0006 9.04e-05 -7.115 0.000 -0.001 -0.000

year_2016 -0.0004 8.84e-05 -5.039 0.000 -0.001 -0.000

year_2017 -0.0002 8.81e-05 -2.175 0.030 -0.000 -1.89e-05

month_2 0.0010 7.23e-05 14.348 0.000 0.001 0.001

month_3 0.0004 7.44e-05 4.885 0.000 0.000 0.001

month_4 0.0005 7.29e-05 6.433 0.000 0.000 0.001

month_5 0.0005 7.22e-05 6.911 0.000 0.000 0.001

month_6 0.0004 7.34e-05 5.687 0.000 0.000 0.001

month_7 0.0007 7.6e-05 8.693 0.000 0.001 0.001

month_8 4.93e-05 7.66e-05 0.644 0.520 -0.000 0.000

month_9 0.0004 7.53e-05 4.810 0.000 0.000 0.001

month_10 0.0006 7.77e-05 8.279 0.000 0.000 0.001

month_11 0.0006 7.57e-05 7.491 0.000 0.000 0.001

month_12 0.0004 7.38e-05 5.094 0.000 0.000 0.001

capital_goods 0.0006 0.000 2.428 0.015 0.000 0.001

consumer_non-durables 0.0004 0.000 1.469 0.142 -0.000 0.001

consumer_services 0.0004 0.000 2.130 0.033 3.6e-05 0.001

energy 0.0001 0.000 0.495 0.621 -0.000 0.001

finance 0.0006 0.000 2.573 0.010 0.000 0.001

health_care 0.0003 0.000 1.733 0.083 -4.55e-05 0.001

miscellaneous 0.0009 0.000 2.445 0.014 0.000 0.002

public_utilities 5.961e-06 0.000 0.018 0.986 -0.001 0.001

technology 0.0008 0.000 3.945 0.000 0.000 0.001

transportation 0.0006 0.000 1.825 0.068 -4.21e-05 0.001

==============================================================================

Omnibus: 32445.335 Durbin-Watson: 2.012

Prob(Omnibus): 0.000 Jarque-Bera (JB): 4401670.731

Skew: -0.255 Prob(JB): 0.00

Kurtosis: 34.066 Cond. No. 77.0

==============================================================================

Notes:

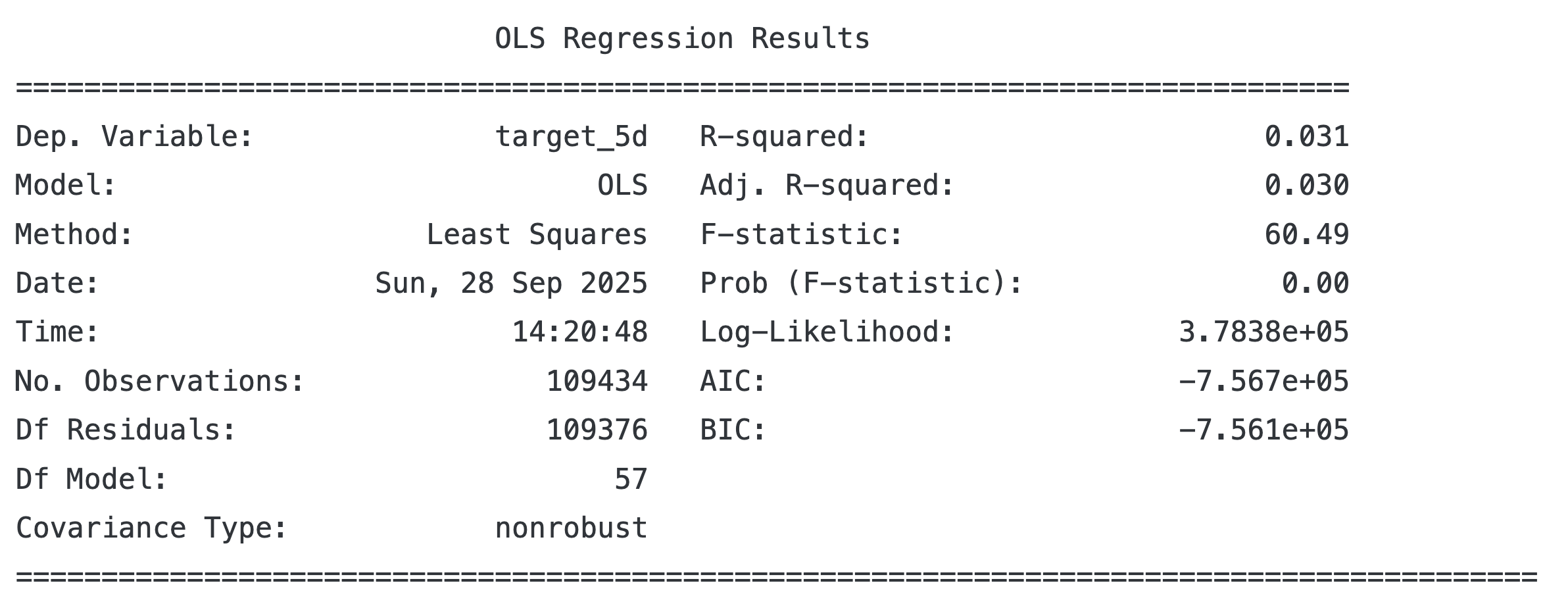

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.5-Day Returns

python

target = 'target_5d'

model = OLS(endog=y[target], exog=add_constant(X))

trained_model = model.fit()

print(trained_model.summary())

R方值比1-Day Returns要高一点

四、Obtain the residuals 计算残差

residuals analysis 残差分析

python

preds = trained_model.predict(add_constant(X))

residuals = y[target] - preds

fig, axes = plt.subplots(ncols=2, figsize=(14,4))

sns.distplot(residuals, fit=norm, ax=axes[0], axlabel='Residuals', label='Residuals')

axes[0].set_title('Residual Distribution')

axes[0].legend()

plot_acf(residuals, lags=10, zero=False, ax=axes[1], title='Residual Autocorrelation')

axes[1].set_xlabel('Lags')

sns.despine()

fig.tight_layout();The residuals are normally distributed, it's good.

残差的分布是正态分布,这是好的。

But the autocorrelation is not good.

残差的自相关图不是很好(前几个Lags自相关系数在0.2以上),说明残差之间不是独立的。

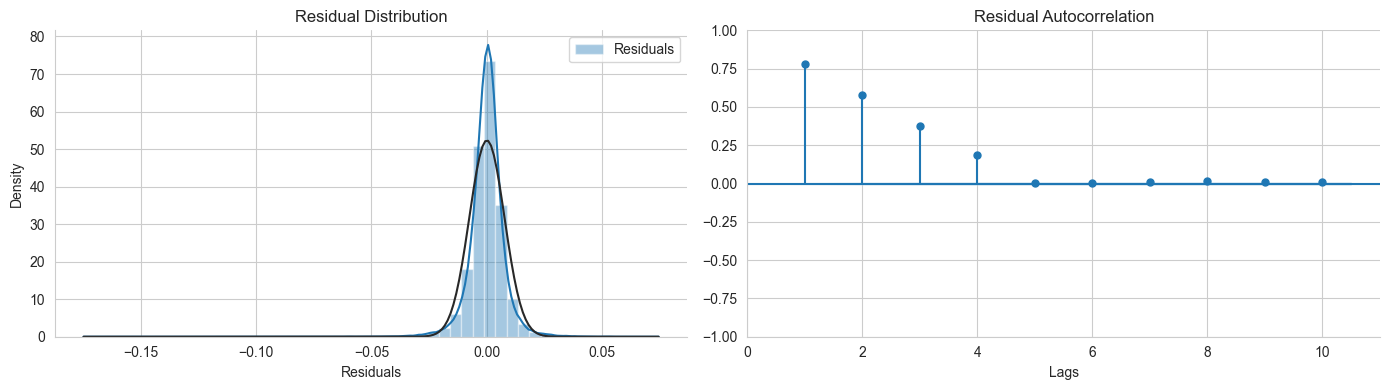

10-Day Returns

python

target = 'target_10d'

model = OLS(endog=y[target], exog=add_constant(X))

trained_model = model.fit()

print(trained_model.summary())

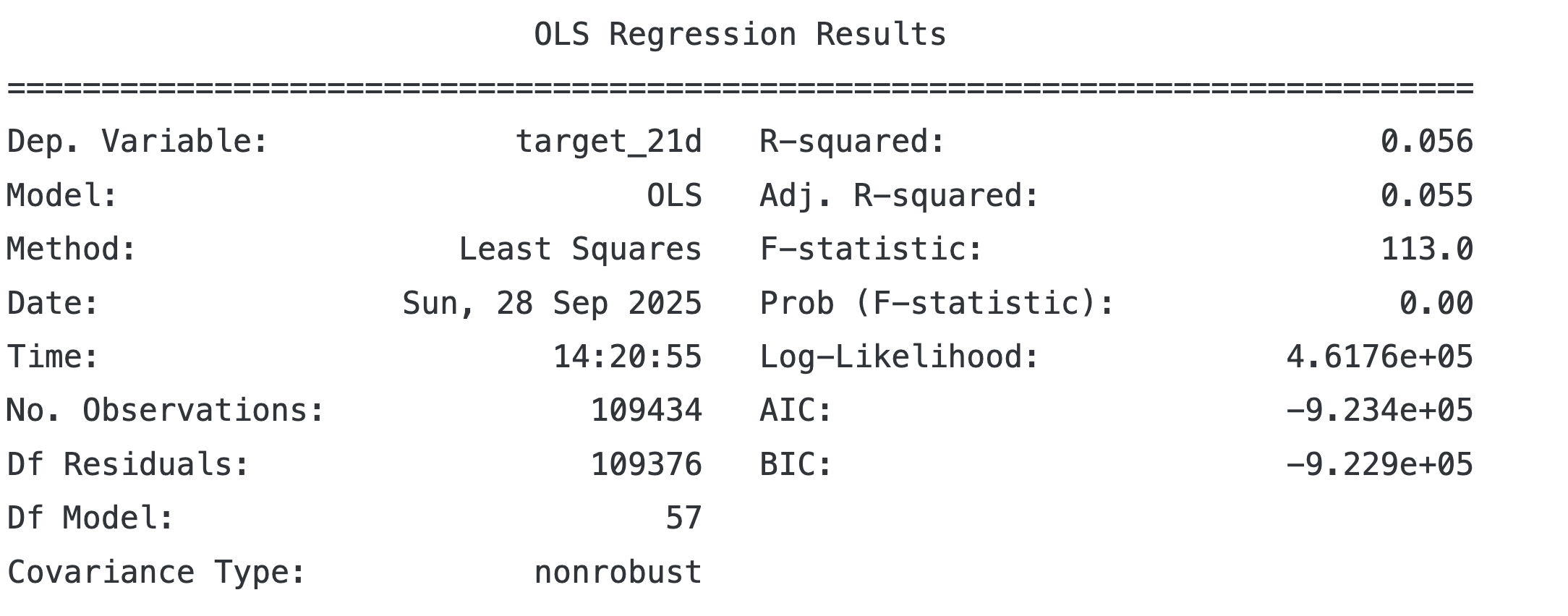

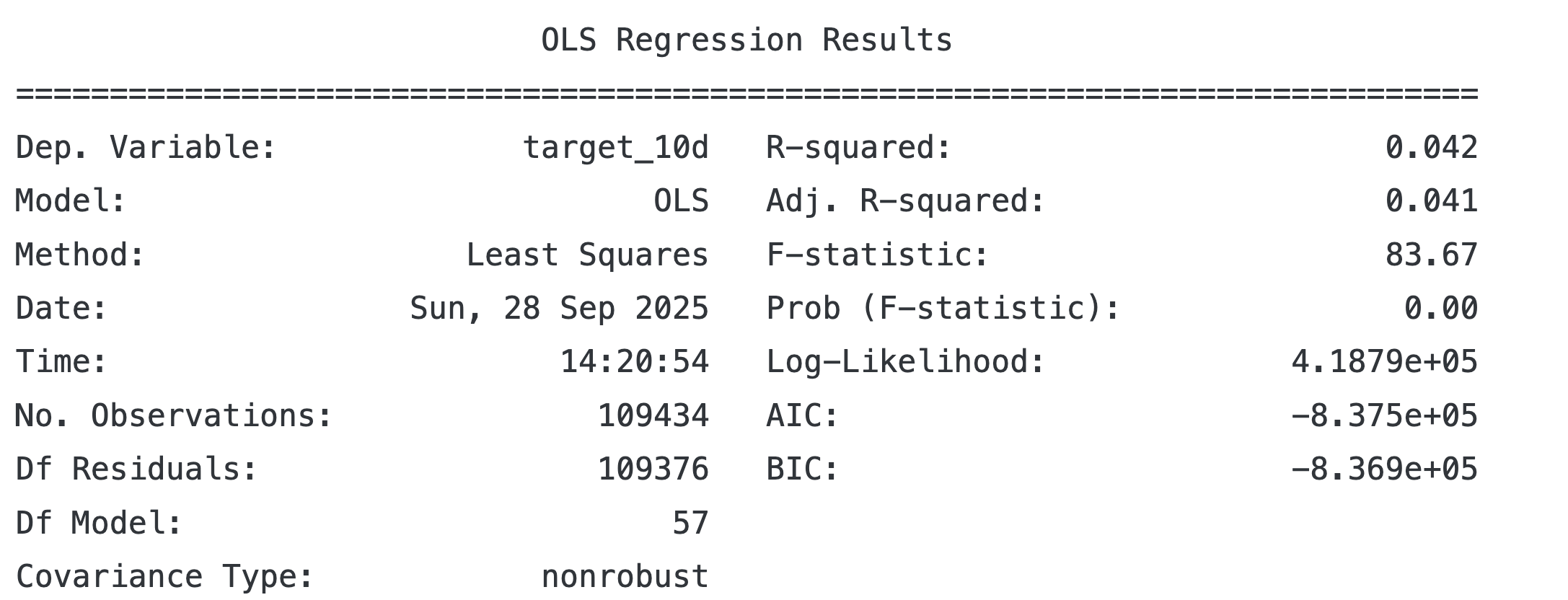

Monthly Returns

python

target = 'target_21d'

model = OLS(endog=y[target], exog=add_constant(X))

trained_model = model.fit()

print(trained_model.summary())